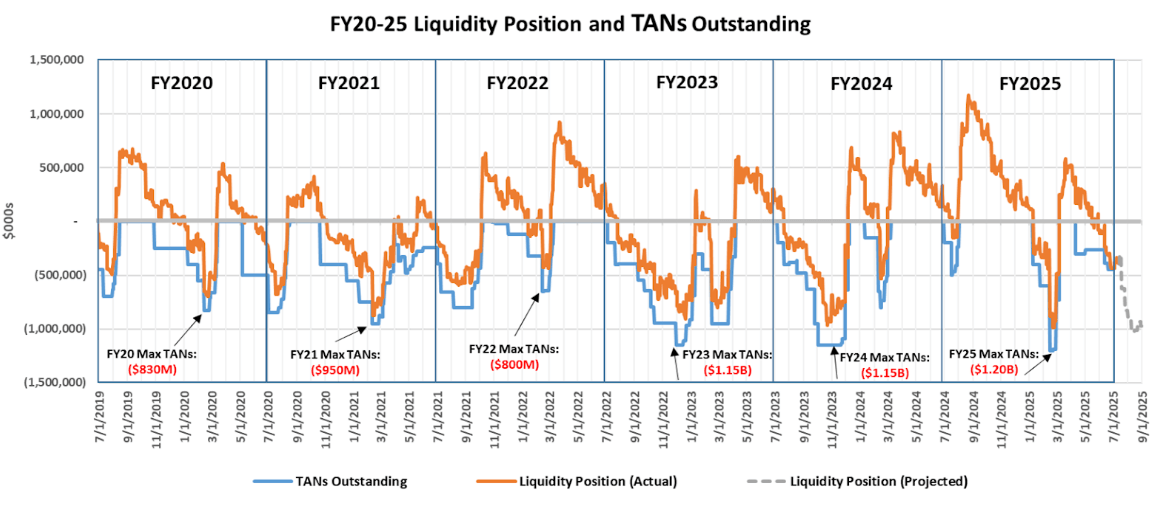

Chicago Public Schools (CPS) does not receive revenues when it pays expenses. As a result, CPS’ cash flow experiences peaks and valleys throughout the year, depending on when revenues and expenditures are received and paid. Furthermore, revenues are generally received later in the fiscal year, while expenditures, which are predominantly payroll, are level across the fiscal year—with the exception of debt service and pensions. The timing of these two large payments (debt service and pensions) occurs just before major revenue receipts of property taxes. These trends in revenues and expenditures, accompanied by a weak cash balance that is not large enough to absorb the differences, put constant cash flow pressure on the District and necessitate the use of cash flow borrowing in the form of Tax Anticipation Notes (TANs) during many parts of the year.

In FY2025, CPS relied more heavily on TANS than in previous years due to the expiration of federal Elementary and Secondary Emergency Relief (ESSER) funding, which increased dependence on other revenue sources that were received less promptly. TANs were used throughout the year to provide needed liquidity. CPS had a maximum amount of $1.2 billion in TANs outstanding in FY2025 just prior to the first installment of FY2025 property taxes on March 3, 2025. The use of TANs will not be eliminated in FY2026 because year-end cash balances have not increased to a targeted level that would be enough to fund operations for just more than 60 days past year end when the second installment of property taxes are typically due and begin to be received by CPS on August 1, 2025 in order to replenish liquidity. Approximately $950 million greater than recent year-end cash position amounts would be needed in order to achieve this at current FY25 budget levels of expenditures.

In FY2025, approximately $5.8 billion, or 77 percent of CPS’ current year revenues, excluding non-cash items, were received after February—more than halfway into the fiscal year. An annual debt service payment of $491 million was made in mid-February, just prior to the receipt of approximately $1.6 billion of the first installment of property tax revenues. Another debt service payment of $44 million was made in mid-March just after receiving the property taxes. The goal is to gradually shift more annual debt service payments into March, after the receipt of property tax revenues, in order to reduce reliance on TANS in mid-February. The annual Chicago Teachers’ Pension Fund (CTPF) pension payment must be made by the end of the fiscal year in late June, just before CPS receives the second installment of property taxes. In FY2025, CPS paid approximately $34 million from operating revenues because the pension property tax levy does not cover the entire amount of the CPS portion of the actuarially required payment.

Historically, approximately 50 percent of the annually budgeted CPS expenditures are for payroll and associated taxes, withholding, and employee contributions. In addition, recurring expenses for educational materials, charter school payments, health care, transportation, facilities, and commodities total approximately 23 percent of annual budgeted expenditures. The timing of these payments is relatively predictable and spread throughout the fiscal year. Approximately 27 percent of budget revenues, which flow through the operating account, comprise debt service, annual pension payments, and interest on short-term debt for cash flow borrowing.

Most organizations set aside cash reserves to weather these peaks and valleys in cash flow. For the first time since FY2022, CPS ended the fiscal year with a negative net cash position, driven by $450 million in outstanding TANS and only around $91 million in cash—resulting in a net cash position of -$358 million. Second installment property tax payments will be delayed beyond the usual August 1 due date, further straining liquidity in the early months of FY2026.

Cash Inflows

CPS has four main sources of operating cash inflows: local, state, and federal revenues and working capital short-term borrowing.

- Local Revenues: Local revenues are predominantly property taxes. In FY2025, CPS will receive approximately $3.9 billion of property taxes, of which $3.4 billion will be allocated to the operating fund, $535 million will be distributed to the CTPF through the pension tax levy, and $6 million will be used to fund capital projects through the Capital Improvement Tax levy. Property tax revenues are received from Cook County in two installments. 96 percent of the property tax monies are received from February onward, which is over halfway through any given CPS fiscal year. The first installment of approximately $1.7 billion was due March 1 and was received into the main operating account in late February and March. The second property tax installment to be counted as FY2025 revenues in the amount of approximately $1.7 billion is anticipated to be delayed past the usual due date of August 1, 2025. Property tax receipts have grown from $2.35 billion in FY2012 to $3.90 billion in FY2025—a compounded growth rate of 4.0 percent. Personal property replacement tax (PPRT) revenue declined by approximately 33 percent compared to FY2024 through June, contributing to less cash at the end of the year. Since FY2023, cumulative PPRT receipts through May have declined by 60 percent, dropping from $536 million in FY2023 to $213 million in FY2025.

- State Revenues: State revenues largely comprise Evidence-Based Funding (EBF) and state grants. EBF is received regularly from August through June in bi-monthly installments. In FY2025, EBF totaled approximately 77 percent of the state revenues budgeted by CPS, up from 57 percent in FY2017 before EBF was created. This increase improves cash flow due to the consistency of the payments. Block grant payments are distributed sporadically throughout the year, with the majority of them being received before June 30.

- Federal Revenues: The state administers categorical grants on behalf of the federal government once grants are approved. The last ESSER funds, amounting to $230 million, were received by January 2025, with no additional ESSER funds remaining.

- Working Capital Short-Term Borrowing: Under state statute and with Board approval, CPS can issue short-term debt in the form of TANs to address liquidity issues. Borrowing with short-term TANs provides upfront money to pay for expenditures when cash is unavailable, and they allow for repayment of the borrowings when property tax revenues are eventually received. In FY2025, CPS issued a maximum amount of $1.2 billion in TANs to support liquidity, an increase of $50 million compared to FY2024. As of June 30, 2025, $450 million of TANS are outstanding at the end of the fiscal year, an increase of $450 million from FY2024. TANs are repaid from the District’s property tax levy used to fund operations. To support liquidity in FY2026, CPS is prepared to issue TANs against property taxes as needed, which will allow liquidity to be maintained throughout the year. Short-term borrowing requires that CPS pays interest on the amounts borrowed. For FY2026, approximately $23.2 million in interest costs for TANs will be budgeted.

Cash Expenditures

CPS expenditures are largely predictable, and the timing of these expenditures can be broken down into three categories: payroll and vendor, debt service, and pensions.

- Payroll and Vendor: Historically, approximately $4.7 billion of CPS’ expenditures are payroll and associated taxes, withholding, and employee contributions. These payments occur every other week, and most expenditures are paid from September through July. In recent years, approximately $2.6 billion of CPS vendor expenses are also relatively stable across the year.

- Debt: Debt service deposits for the payment of bonds that have been issued to fund capital improvements is required to be made once a year on February 15 and March 15 from the state aid EBF revenue that CPS receives. In FY2025, the CPS debt service deposit from EBF was approximately $491 million in February and $44 million in March. The objective is to slowly move more annual debt service payments to March, following the collection of property tax revenues, to decrease the dependence on TANS in mid-February. The timing of the debt service deposit in February comes just before CPS received approximately $1.7 billion in property tax revenues. In addition to EBF, a portion of the debt service on the bonds that have been issued is paid by PPRTs and/or property taxes deposited directly with the trustee, meaning they do not pass through the District’s operating fund from a cash perspective. The bond documents dictate the timing and amount of these payments. Once the trustees have verified that the debt service deposit is sufficient, they provide a certificate to the CPS, which then allows the backup property tax levy that supports the bonds to be abated.

- Pensions: In FY2025, CPS contributed $34 million to the CTPF by the fiscal year-end on June 30, 2025, from unrestricted operating funds. Additionally, in FY2025, the dedicated pension property tax levy will directly intercept and deposit approximately $535 million in revenue to the CTPF. These revenues do not pass through the District’s operating funds from a cash perspective (see the Pensions chapter for more detail on FY2025 funding sources).