The FY2026 Budget will include $1,026.7 million for the Chicago Teachers’ Pension Fund (CTPF). With strong investment returns thanks to a favorable market, this amount is $18.1 million less than what CTPF forecasted last year for FY2026’s projected contribution. Funding from the State of Illinois (the State) also increased due to higher-than-expected payroll. Since the overall employer contribution requirement decreased from last year’s projection—down from $1,044.8 million—and the State’s contribution increased, CPS’ contribution decreased.

With a strong investment market in FY2022 and increased pension levy revenues, CPS did not need to spend any of its operating revenue on CTPF contributions for FY2023—the first time in the last twenty years where CTPF was wholly funded by dedicated state and local revenue sources. In FY2024, and to a lesser degree in FY2025, CPS had to once again divert operational revenue to help cover its statutory contribution. This will happen yet again in FY2026, but to a lesser degree than what was seen in FY2024 and FY2025. Whereas the operating revenue diversion exceeded $140 million in FY2024, FY2026 will see a projected operating revenue diversion of less than half that, settling in at $61.3 million. As yearly contribution estimates grow due to the pension payment ramp, CPS expects that for the next nine years the levy revenue alone will not be enough to cover CPS’ contribution to the CTPF. This means CPS will need to continue diverting operating revenue to cover the difference.

The structural changes enacted in FY2017 and FY2018 that altered the funding mechanisms supporting the CTPF provided several key measures to ensure long-term pension health. In FY2017, the Illinois General Assembly granted CPS the ability to implement a property tax levy dedicated to funding the CTPF at a tax rate of 0.383 percent of the Equalized Assessed Value (EAV) of Chicago properties. That rate was then raised in FY2018 to a maximum rate of 0.567 percent. Additionally, in FY2018, the State made a commitment to pay the employer’s normal cost for pension obligations, which is the amount of future pension benefits that CTPF-eligible employees will accrue over a given fiscal year. In FY2025, this normal cost comes out to 33.4 percent of the total employer contribution amount. Despite these improvements, CPS still bears legacy costs that have—aside from FY2023—required the use of operating revenue to cover the difference between the levy’s revenue and CPS’ statutory pension payment. Nonetheless, CPS continues to make all statutory contributions to the CTPF in accordance with the pension ramp, which has the mandate that CTPF be 90 percent funded by FY2059.

These costs are a burden unique to CPS. CPS remains the only school district in the State with its own teachers’ pension system separate from the statewide Teachers’ Retirement System (TRS). Full-time salaried CPS teachers and other licensed teaching staff are part of the CTPF, which, until recently, has been funded almost entirely by Chicago taxpayers with little support from the State. Under this arrangement, Chicago taxpayers have faced the unique burden of having to support both the CTPF and the TRS. Like all other working Illinoisans, portions of their income, corporate, and sales taxes paid to the State go toward funding TRS costs, but Chicagoans bear the additional burden of supporting most of the CTPF costs through property taxes and other local revenue streams.

Per the CTPF’s 2024 actuarial report, the total statutory, or required, employer contribution to the CTPF for FY2026 will be $1,026.7 million. Of that number, the State will pay $363.1 million, which is comprised of the projected normal cost of $346.8 million and $16.3 million to offset the benefit increases enacted under Public Act 90-0582 (this is set at 0.544 percent of the CTPF’s total payroll pursuant to Public Act 90-0655). This total of $363.1 million also includes $65 million in the form of a health insurance subsidy for retirees.

CPS’ required contributions for FY2026 amount to $663.6 million. The pension property tax levy is projected to raise $602.3 million in FY2026. This is up $0.9 million from the initial budgeted projection for FY2025. This means that the Chicago Board of Education will be responsible for funding the remaining $61.3 million differential out of its operating revenues to meet the total required contribution for CPS of $663.6 million. The operational diversion is down from $142.7 million in FY2024 and $102.9 million in FY2025 to $61.3 million in FY2026. Much of this decrease stems from stability in total CPS required contributions paired with simultaneous increases in the pension levy revenue year-over-year.

Chart 1: Projected FY2026 Funding for Required CTPF Employer Contributions ($ in Millions)

A Strong Market Boosts Funded Ratios for the CTPF

The funded ratio of the CTPF based on the actuarial value of assets (AVA) increased to 48.1 percent as of June 30, 2024, up from 47.2 percent on June 30, 2023. This actuarial value is determined by a four-year smoothing method that helps account for unexpected gains or losses and provides better baselines for long-term fiscal planning. Therefore, it is more stable year-to-year than the market value of assets (MVA) detailed below.

The increase in the funded ratio stems from a higher-than-expected return on the actuarial value of assets in FY2024, which came in at 8.1 percent instead of the assumed rate of 6.5 percent. When using the MVA to estimate, which examines the unadjusted returns within a fiscal year, we see that the funded ratio also rose from 46.3 percent as of June 30, 2023, to 47.5 percent as of June 30, 2024. The return on market value of assets was 8.2 percent in FY2023 and approached 9.0 percent in FY2024. For context, the ten-year average for market value investment return is 6.6 percent, while the ten-year average for the actuarial value investment return is 7.5 percent.

The unfunded actuarial accrued liability (UAAL) for CTPF grew by $129.5 million to $13.94 billion. While the UAAL increased, it increased at a lower rate than expected. The expected increase in UAAL was pegged at $191 million, but thanks to higher-than-expected investment income, the UAAL increase was only two-thirds of the initial expectation. The UAAL is calculated by taking the total accumulated cost of pension benefits and subtracting the value of the total assets in the plan’s possession.

The State Continues to Fund CTPF at a Lower Rate than the TRS

The passage of state education funding reform in 2017 began to address a pension system that unfairly penalized Chicagoans. Even though both the CTPF and TRS are governed by state statute, there has been a vast difference in the source of funding for both pension systems. The State is projected to pay $363.1 million in FY2026 for CTPF teacher pension costs, which represents 35.4 percent of the total employer contribution. In FY2025, the State contributed $6.20 billion towards the mandatory employer cost for the TRS. In FY2026, the TRS will receive $6.50 billion from the State, which comprises 98.2 percent of non-member contributions. Accounting for an additional $26.5 million in contributions from federal funds, school districts across the State are only required to contribute 1.3 percent of the annual required contribution amounts. When compared to CPS’ requirement to contribute 64.6 percent of total employer cost, the discrepancy becomes stark.

Another way to think about this difference is to examine the average contribution from the State to the two retirement funds on a per pupil basis. In FY2026, the State’s estimated contribution to TRS amounts to a pension contribution for downstate and suburban school districts of $4,260.29 per student, while CPS will only receive $1,113.40 per student.

Chart 2: Average Contribution per Pupil by the State to the TRS and CTPF in FY2026

CPS’ Employer Contribution Requirements: Diverting Operating Funds to Bridge the Gap

In FY2026, CPS is projected to contribute $663.6 million for Chicago teachers’ pensions, with $61.3 million of its own operating revenue and $602.3 million from the dedicated pension levy. The State will pick up the other $363.1 million, of which $346.8 million is for normal CTPF costs, and $16.3 million is for “additional” state contributions. These “additional” state contributions are statutorily required to offset the portion of the cost of benefit increases enacted under Public Act 90-0582 and are calculated as 0.544 percent of CTPF’s total teacher payroll.

Chicago property values are projected to experience continued growth in the long term, bringing with it increased opportunity for additional revenue. However, the rate of increase for the levy revenues in FY2025 was not able to keep up with the need for additional funds to compensate for investment losses incurred over the prior year. Of the $663.6 million CPS must contribute for FY2026, $602.3 million will come from the pension levy revenue and $61.3 million will come from operating revenue diversions.

In FY2026, the increase of $43.6 million in pension levy revenues will still not be enough to keep pace with the increasing mandatory contributions due to the pension payment ramp. CPS must once again divert operating revenue to help complete the statutory contributions, albeit at a lower amount than observed in FY2024 and FY2025. Based on estimations of pension levy growth due to an increased EAV, CPS will continue to rely on operating revenue to bridge the gap of statutory contributions until approximately FY2034. This estimate remains constant from last year.

Chart 3: Diversions from Operating Revenues are Projected to Continue Through FY2034 Without Increased State Funding

Pension Contributions by the State and Individual Employees

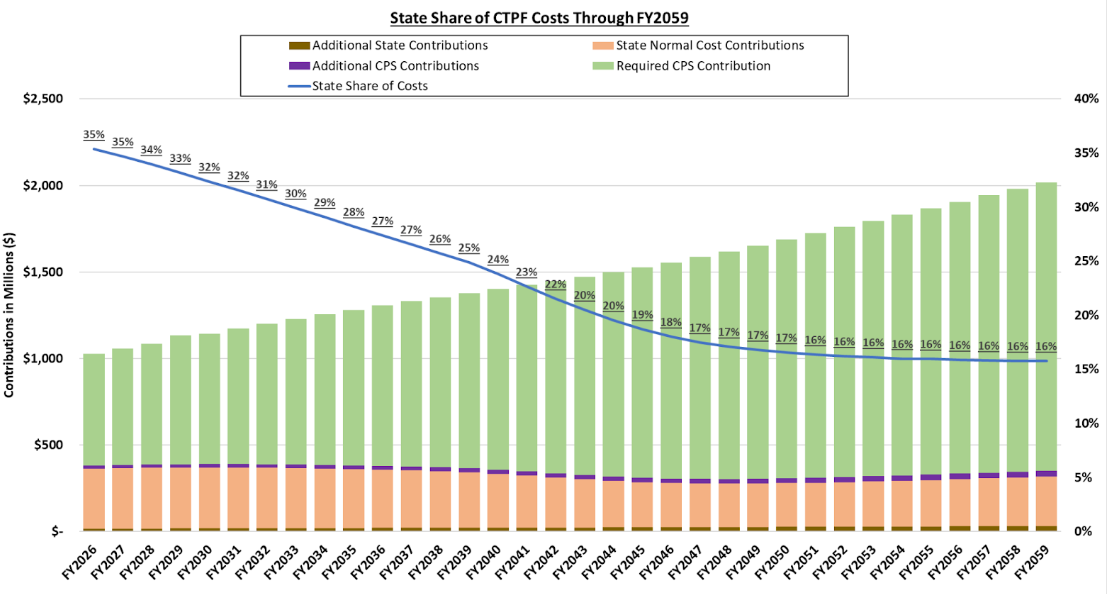

As the total employer contribution costs continue to increase in accordance with the actuarially required amount in order to reach a 90 percent funded ratio of CTPF by 2059, State contributions will shrink as a total share of the overall revenues used to cover this cost, if limited to just the normal cost and the “additional” 0.544 percent of payroll pursuant to Public Act 90-0655 to cover increased cost of benefit increases enacted under Public Act 90-0582.

In FY2026, the State’s contribution is projected to make up 35.4 percent of the total employer contribution, and this is scheduled to decline to 16 percent by 2059 if there is no further expansion of the CTPF’s employer cost assumed by the State. The normal cost borne by the State will gradually decline as a greater share of the workforce becomes “Tier II” teachers who are entitled to a less generous level of benefits than “Tier I” employees. CPS is reliant on the State continuing to add funding to the Evidence-Based Funding (EBF) model so that future pension costs do not prohibit us from investing in students and schools. If funding strategies are not changed at the State level, CPS expects its contribution to CTPF to double between FY2026 and FY2048—increasing from $663.6 million to $1,342.2 million. By FY2059, CPS will need to contribute $1,665 million annually to the CTPF to cover pension payments. More discussion on the State’s EBF formula can be found in the Revenue chapter of the Budget Book.

Chart 4: The State Share of CTPF Contributions Will Shrink in Future Years ($ in Millions)

At the individual level, employees covered by CTPF are required by statute to contribute 9 percent of their salary to pensions. However, from 1981 through 2017, CPS paid the first 7 percent on the employee’s behalf, in addition to its own employer contribution. Under the 2019–24 Collective Bargaining Agreement with the Chicago Teachers Union, CPS no longer paid the initial 7 percent for “Tier II” employees hired on or after January 1, 2017, leaving them to contribute the entirety of that 9 percent. This will continue under the 2024–28 Collective Bargaining Agreement with the Chicago Teachers Union.

Decline in Funded Ratio Led to Increased CPS Contributions

Until June 30, 2001, CTPF had a funded ratio of 100 percent, and according to State law, CPS did not have to make an employer contribution. By June 30, 2004, the funded ratio had dropped to 86 percent, below the 90 percent threshold, and therefore CPS was statutorily required to begin making employer contributions. State funds would not begin to ramp up in earnest, however, until the passing of Public Act 99-521, which took effect in 2017. As seen in the graph below, the District is on course to meet the FY2059 deadline of being 90 percent funded. A full explanation of the designated baseline ramp can be found in the FY2024 Actuarial Valuation Report.

Chart 5: CTPF Funded Ratio Through FY2059 (Actuarial Value of Assets and Market Value of Assets)

MEABF Contributions

Employees of CPS who do not participate in the CTPF participate in the Municipal Employees’ Annuity and Benefit Fund (MEABF). The MEABF is a City of Chicago pension annuity fund established to fund retirement for most civil service employees of the City of Chicago. Non-teacher employees of CPS are also allowed to be part of the fund.

The employer's proportionate share of collective pension expense is recognized as on-behalf payment as both revenue and expenditure in CPS' budget. However, CPS' budget allows the District, in FY2026, to reimburse the City for expenses related to MEABF if CPS receives additional FY2026 state revenues, additional FY2026 TIF surplus revenue, or other FY2026 local resources above budgeted levels. The amount of the potential reimbursement is contingent upon the amount of additional revenue CPS actually receives in FY2026. CPS is willing to pay the City within 30 days of receipt of the referenced additional revenues.