Debt Overview

The Board of Education is authorized by state law to issue notes and bonds, enter into lease agreements for capital improvement projects, and assist in the management of cash flow and liquidity. As of June 1, 2022, the Board has approximately $8.6 billion of outstanding long-term debt and no outstanding short-term debt. FY2023 includes appropriations of $769 million for long-term debt service payments. Approximately $9 million of appropriations for interest on short-term debt is included in the operating budget.

Capital Improvements and Debt

CPS’ Capital Improvement Program, described in the Capital chapter, funds long-term investments that provide our students with a world-class education in high-quality learning environments. CPS relies on the issuance of bonds to fund the investments laid out in the program, which include roofs, envelopes, and windows; state-of-the-art high school science labs; high-speed internet and digital devices; playgrounds and athletic fields; and the expansion of full-day pre-k and other high-quality programs. Bonds are debt instruments that are similar to a loan, requiring annual principal and interest payments.

Typically, CPS issues long-term fixed-rate bonds, which pay a set interest rate according to a schedule established at the time of debt issuance. As of June 1, 2022, all CPS outstanding long-term debt is fixed rate.

Debt Management Tools and Portfolio

As part of the Debt Management Policy, CPS is authorized to use a number of tools to manage its debt portfolio including refunding existing debt and issuing short-term or long-term debt. These tools are used to manage various types of risks, generate cost savings, address interim cash flow needs, and assist capital asset planning. CPS issues two types of long-term debt: Alternate Revenue General Obligation bonds and Capital Improvement Tax bonds.

Alternate Revenue General Obligation Bonds

Similar to most Illinois school districts, CPS issues bonds backed by the full faith and credit of the Board, otherwise known as General Obligation (GO) bonds. These GO bonds are paid for from all legally available revenues of the Board. CPS issues a special type of GO bond called an “Alternate Revenue” GO bond. These bonds are backed by two revenue sources and offer a number of other bondholder protections.

The first revenue source that supports CPS alternate revenue bonds is one of the following: Evidence Based Funding (EBF) from the State of Illinois (known as “General State Aid'' prior to FY2018), Personal Property Replacement Taxes (PPRT), revenues derived from intergovernmental agreements with the City of Chicago (IGAs), and federal interest subsidies. The majority of CPS bonds are backed by EBF. In FY2023, approximately $502 million in EBF revenues will be required for debt service, compared to $480 million in FY2022 and $446 million in FY2021. In addition to debt service funded by EBF, $39 million of debt service will be paid from PPRT in FY2023. Debt service paid from PPRT revenues also reduces PPRT revenues available for operating purposes. Additionally, $142 million in debt service will be paid by revenue resulting from IGAs.

CPS has benefited from issuing bonds with federal interest subsidies, resulting in a very low cost of borrowing. These include Qualified School Construction Bonds (QSCBs) and Build America Bonds (BABs) created by the American Recovery and Reinvestment Act of 2009 (ARRA). The FY2023 budget includes $25 million of federal subsidies for debt service.

The second revenue source for all CPS Alternate Revenue GO bonds is a property tax levy that is available to support debt service should the first pledge of revenue not be available. On an annual basis, when the first source of revenue is available to pay debt service, the property tax levy will be abated, and not extended, as it has been every year.

The Board is authorized to issue alternate revenue bonds after adopting a resolution and satisfying public notice publication and petition period requirements in lieu of a voter referendum, which is typical in other school districts. The bonds are also supported by the GO pledge of the Board to use all legally available revenues to pay debt service.

Capital Improvement Tax Bonds

In FY2016, CPS began levying a Capital Improvement Tax (CIT) levy to fund capital projects. As of June 1, 2022, CPS has sold three series of CIT bonds, and the total amount of outstanding CIT bonds is $880 million.

The FY2023 budget includes a CIT levy and appropriations of approximately $51 million to pay debt service on CIT bonds. The CIT bonds are not Alternate Revenue GO bonds. They are limited obligations of the Board payable solely from the CIT levy.

Tax Anticipation Notes

In recent fiscal years, the Board has relied on short-term borrowing to fund operations and liquidity. These short-term borrowings have primarily consisted of the issuance of tax anticipation notes (TANs), payable from the collection of education fund real estate property taxes levied by the Board for a given year.

Credit Ratings

Credit rating agencies are independent entities, and their purpose is to give investors or bondholders an indication of the creditworthiness of a government entity. A high credit score can lower the cost of debt issuance, just as a strong personal credit score can reduce the interest costs of loans and credit cards. Ratings consist of a letter “grade,” such as A, BBB, BB, or B, and a credit “outlook,” or expectation of the direction of the letter grade. Thus, a “negative outlook” anticipates a downgrade to a lower letter grade, a “stable outlook” means the rating is expected to remain the same, and a “positive outlook” may signal an upgrade to a higher rating.

CPS meets frequently with the credit rating agencies about its budget, audited financial results, debt plan, and management initiatives to ensure the agencies have the most updated information possible. The rating agencies take several factors into account in determining any rating, including management, debt profile, financial results, liquidity, and economic and demographic factors. In FY2022, CPS received general obligation credit rating upgrades from Kroll Bond Rating Agency (BBB Stable and BBB+ for series issued from 2016 to 2019), Fitch (BB+ Stable) and Moody’s (Ba2 Stable). Standard & Poor’s currently rates CPS GO bond series BB Stable.

In addition to the CPS GO bond rating, the CIT bonds––which were first issued in FY2017 as a new and separate credit structure from the existing CPS general obligation credit––contain a separate and distinct credit rating. The CIT credit structure received an investment grade rating from two rating agencies at inception in FY2017. Currently, Fitch Ratings rates the CIT credit A Stable and Kroll Bond Rating Agency rates the CIT credit BBB+ Stable. Both ratings received a one-notch upgrade in FY2022.

| Credit Rating | General Obligation | Capital Improvement Tax | ||||

|---|---|---|---|---|---|---|

| Rater | KBRA* | Fitch | S&P | Moody's | Fitch | KBRA |

| Current | BBB | BB+ | BB | Ba2 | A | BBB+ |

| FY21 | BBB- | BB | BB | Ba3 | A- | BBB |

| FY20 | BBB- | BB | BB- | B1 |

A |

BBB |

| FY19 |

BBB- |

BB- | B+ | B2 | A | BBB |

| FY18 |

BBB- |

BB- | B | B3 | A | BBB |

| FY17 | BBB- | BB- | B | B3 | A | BBB |

| FY16 | BBB- | B+ | BB | B2 | A | BBB |

| FY15 | BBB+ | BBB- | A- | Ba3 | ||

| FY14 | A- | A+ | Baa1 | |||

| FY13 | A- | A+ | A3 | |||

| FY12 | A | A+ | A2 | |||

FY2023 Liquidity and Short-term Borrowing

It is anticipated that the Board will issue Educational Purposes TANs in FY2023 to fund operating liquidity and cash flow needs similar to prior fiscal years. In the last three fiscal years, the Board closed on multiple annual series of TANs for working capital purposes. The TANs were issued as either public sales or direct placement with investors. The initial issuance of TANs typically occurs in October. Subsequently, the principal amount of TANs outstanding increased with cash flow needs and has typically peaked initially in February due to the annual debt service deposit for the Board’s alternate revenue bonds required on February 15. The collection of the first installment of property taxes historically has improved the Board’s cash position and resulted in a repayment of a portion of the Board’s outstanding TANs. A second peak is typically experienced in July, due to additional cash needs and the Board’s annual pension contribution required on June 30. TANs are typically repaid fully in August with the collections of the second installment of property taxes. The FY2023 operating budget includes appropriations of approximately $9 million to pay debt service on TANs.

FY2023 Debt Service Costs

As shown in the table below, FY2023 includes total appropriations of approximately $769 million for long-term alternate bonds and CIT bonds. Of this total, approximately $542 million will be funded from operating revenues. In addition, approximately $9 million of total appropriations are budgeted for TANs interest within the operating fund.

CPS is required to set aside long-term debt service one year in advance for EBF-funded debt and one-and-a-half years in advance for PPRT and CIT bond-funded debt service. The FY2023 revenues shown in the following table for debt service will be set aside for these future debt payments, which are required by bond indentures to be held in trust with an independent trustee. PPRT, used to pay alternate revenue bonds, is deposited directly from the state to a trustee; and the CIT levy, used to pay CIT bonds, is deposited directly from Cook County to a trustee. Because of this set-aside requirement, the majority of the appropriations for FY2023 will be paid from revenues set aside in FY2022. Table 2 provides information on the debt service fund balance at the beginning of the year, the expenditures that are made from the debt service fund, and the revenues that largely fund the debt service requirements for the following fiscal year.

| FY2021 Actual | FY2022 Estimated | FY2023 Budget | ||

|---|---|---|---|---|

| Beginning Fund Balance | 793.5 | 833.6 | 877.7 | |

| Revenues: | ||||

| Evidence-Based Funding (State Aid) | 454.5 | 480.3 | 502.1 | |

| Personal Property Replacement Tax | 39.4 | 39.4 | 39.4 | |

| Intergovernmental Agreements | 99.52 | 185.12 | 142.3 | |

| Federal Interest Subsidy | 25.0 | 24.7 | 24.6 | |

| Capital Improvement Tax | 51.5 | 51.1 | 51.1 | |

| Interest Earnings | 1.2 | 2.0 | 3.0 | |

| Total Revenue | 671.0 | 782.7 | 762.5 | |

| Expenses: | ||||

| Existing Bond Principal payment | 176.3 | 238.6 | 259.2 | |

| Existing Bond Interest payment | 483.3 | 524.2 | 509.7 | |

| Fees | 1.9 | 0.5 | 0.5 | |

| Total Existing Bond Debt Service | 661.5 | 763.3 | 769.4 | |

| Other Financing Sources | ||||

| Net Amounts from Debt Issuances | 31.9 | 25.2 | 0 | |

| Transfers in /(out) | (1.3) | (0.5) | (0.5) | |

| Total other Financing Sources /(Uses) | 30.6 | 24.7 | (0.5) | |

| Ending Fund Balance | 833.6 | 877.7 | 870.2 | |

Future Debt Service Profile

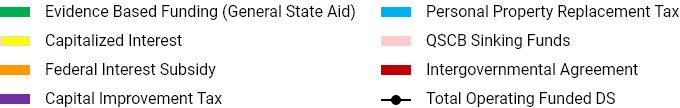

The following graph illustrates CPS’ debt obligations on outstanding long-term bonds as of June 1, 2022. This graph does not show the impact of short-term tax anticipation note borrowings to support operating fund liquidity or any future bonds required to support future capital budgets or debt restructuring.

Chart 1: CPS Debt Service Funding Schedule (as of June 1, 2022)

Note: Does not include future long-term bond financings or current or future short-term financings

Measuring Debt Burden

External stakeholders, such as taxpayers, employees, parents, government watchdog groups, rating agencies, and bondholders, frequently review CPS’ debt profile to gauge its size and structure as a crucial component of CPS’ financial position. In addition to evaluating the total amount of outstanding debt and the annual debt service payments, external stakeholders also look at the “debt burden” to gauge how much taxpayers bear in debt costs and determine how much debt is affordable for residents, which establishes true debt capacity. Several methods of measuring debt burden are commonly employed for school districts, including comparing existing debt to legal debt limits, measuring debt per capita, and measuring debt as a percentage of operating expenditures.

Legal Debt Limit

The Illinois School Code imposes a statutory limit of 13.8 percent on the ratio of the total outstanding property tax-supported general obligation debt a school district may borrow compared with a school district’s equalized assessed value, which generally represents a fraction of total property value in the district. Because the Board has issued alternate revenue bonds for which property tax levies are not extended, these bonds do not count against the legal debt limit imposed by the Illinois School Code. The Board currently has no outstanding property tax-backed general obligation debt that counts toward the debt limit.

Debt Per Capita

The Board’s per capita debt burden, or total debt divided by the City of Chicago’s population, has increased in the last decade. As reported in the FY2021 Annual Comprehensive Financial Report, General Obligation debt per capita is $2,639. This is still considered moderate to slightly above average relative to other comparable school districts. The Debt Management Policy is available at the Board’s website at policy.cps.edu.

| Description | Closing Date | Maturity Date | Principal Outstanding | Pledged Funding Source for Debt Service |

|---|---|---|---|---|

| ULT GO Series 1998B-1* | 10/28/98 | 12/01/31 | $170,553,052 | IGA / PPRT |

| ULT GO Series 1999A* | 02/25/99 | 12/01/31 | 253,191,576 | IGA / PPRT |

| ULT GO Series 2005A | 06/27/05 | 12/01/32 | 125,670,000 | EBF |

| ULT GO BAB Series 2009E | 09/24/09 | 12/01/39 | 482,615,000 | EBF / Federal Subsidy |

| ULT GO QSCB Series 2009G | 12/17/09 | 12/15/25 | 254,240,000 | EBF |

| ULT GO QSCB Series 2010C | 11/02/10 | 11/01/29 | 257,125,000 | EBF / Federal Subsidy |

| ULT GO BAB Series 2010D | 11/02/10 | 12/01/40 | 125,000,000 | EBF / Federal Subsidy |

| ULT GO Series 2012A | 08/21/12 | 12/01/42 | 468,915,000 | EBF |

| ULT GO Series 2012B | 12/21/12 | 12/01/35 | 109,825,000 | EBF |

| ULT GO Series 2015CE | 04/29/15 | 12/01/39 | 280,000,000 | EBF |

| ULT GO Series 2015E | 04/29/15 | 12/01/32 | 20,000,000 | EBF |

| ULT GO Series 2016A | 02/08/16 | 12/01/44 | 725,000,000 | EBF |

| ULT GO Series 2016B | 07/29/16 | 12/01/46 | 150,000,000 | EBF |

| CIT Series 2016 | 01/04/17 | 04/01/46 | 729,580,000 | CIT |

| ULT GO Series 2017A | 06/13/17 | 12/01/46 | 285,000,000 | EBF |

| ULT GO Series 2017B | 06/13/17 | 12/01/42 | 215,000,000 | EBF |

| CIT Series 2017 | 11/30/17 | 04/01/46 | 64,900,000 | CIT |

| ULT GO Series 2017C | 11/30/17 | 12/01/34 | 282,590,000 | EBF |

| ULT GO Series 2017D | 11/30/17 | 12/01/31 | 62,960,000 | EBF |

| ULT GO Series 2017F | 11/30/17 | 12/01/24 | 96,695,000 | IGA |

| ULT GO Series 2017G | 11/30/17 | 12/01/44 | 126,500,000 | PPRT / EBF |

| ULT GO Series 2017H | 11/30/17 | 12/01/46 | 280,000,000 | PPRT / EBF / IGA |

| ULT GO Series 2018A | 06/01/18 | 12/01/35 | 507,165,000 | EBF |

| ULT GO Series 2018B | 06/01/18 | 12/01/22 | 4,730,000 | EBF |

| ULT GO Series 2018C | 12/13/18 | 12/01/32 | 419,490,000 | EBF |

| ULT GO Series 2018D | 12/13/18 | 12/01/46 | 313,280,000 | PPRT / EBF |

| CIT Series 2018 | 12/13/18 | 12/01/46 | 86,000,000 | CIT |

| ULT GO Series 2019A* | 09/12/19 | 12/01/30 | 225,283,872 | IGA |

| ULT GO Series 2019B | 09/12/19 | 12/01/33 | 123,295,000 | EBF |

| ULT GO Series 2021A | 2/11/21 | 12/1/41 | 450,000,000 | EBF / IGA |

| ULT GO Series 2021B | 2/11/21 | 12/1/36 | 100,975,000 | EBF |

| ULT GO Series 2022A | 2/1/22 | 12/1/47 | 500,000,000 | EBF |

| ULT GO Series 2022B | 2/1/22 | 12/1/41 | 372,170,000 | EBF |

| Total Principal Outstanding | $8,649,748,500 | |||

| Description | Maturity Date | Principal Outstanding | Pledged Funding Source for Debt Service |

|---|---|---|---|

| Tax Anticipation Notes, Series 2021A | 12/31/22* | $0 | Ed Fund Property Tax |

| Tax Anticipation Notes, Series 2021B | 12/31/22* | 0 | Ed Fund Property Tax |

| Tax Anticipation Notes, Series 2021C | 12/31/22* | 0 | Ed Fund Property Tax |

| Total Principal Outstanding | $0 | ||

| Fiscal Year ending June 30 | GO Bond Principal | GO Bond Interest | Total GO Bond Debt Service |

|---|---|---|---|

| 2023 | $258,017 | $450,359 | $708,376 |

| 2024 | 267,283 | 442,907 | 710,190 |

| 2025 | 323,272 | 438,508 | 761,780 |

| 2026 | 305,942 | 426,505 | 732,447 |

| 2027 | 302,547 | 487,846 | 790,393 |

| 2028 | 282,964 | 443,006 | 725,970 |

| 2029 | 292,236 | 441,366 | 733,602 |

| 2030 | 277,139 | 415,993 | 693,132 |

| 2031 | 263,066 | 374,967 | 638,033 |

| 2032 | 238,025 | 259,139 | 497,164 |

| 2033 | 250,345 | 246,440 | 496,785 |

| 2034 | 242,500 | 235,578 | 478,078 |

| 2035 | 253,530 | 220,032 | 473,562 |

| 2036 | 261,350 | 200,354 | 461,704 |

| 2037 | 272,480 | 191,975 | 464,455 |

| 2038 | 285,640 | 178,081 | 463,721 |

| 2039 | 299,500 | 162,523 | 462,023 |

| 2040 | 314,655 | 146,197 | 460,852 |

| 2041 | 328,395 | 128,017 | 456,412 |

| 2042 | 350,114 | 101,668 | 451,782 |

| 2043 | 355,583 | 96,195 | 451,778 |

| 2044 | 385,143 | 66,637 | 451,780 |

| 2045 | 403,776 | 48,004 | 451,780 |

| 2046 | 425,560 | 26,220 | 451,780 |

| 2047 | 65,000 | 2,850 | 67,850 |

| TOTAL | $7,304,062 | $6,231,367 | $13,535,429 |

| Fiscal Year ending June 30 | CIT Bond Principal | CIT Bond Interest | Total CIT Bond Debt Service |

|---|---|---|---|

| 2023 | $- | $51,084 | $51,084 |

| 2024 | - | 51,084 | 51,084 |

| 2025 | - | 51,084 | 51,084 |

| 2026 | - | 51,084 | 51,084 |

| 2027 | - | 51,084 | 51,084 |

| 2028 | - | 51,084 | 51,084 |

| 2029 | - | 51,084 | 51,084 |

| 2030 | - | 51,084 | 51,084 |

| 2031 | - | 51,084 | 51,084 |

| 2032 | - | 51,084 | 51,084 |

| 2033 | 42,615 | 51,084 | 93,699 |

| 2034 | 45,000 | 48,692 | 93,692 |

| 2035 | 47,535 | 46,164 | 93,699 |

| 2036 | 50,205 | 43,494 | 93,699 |

| 2037 | 53,170 | 40,531 | 93,701 |

| 2038 | 56,260 | 37,434 | 93,694 |

| 2039 | 59,540 | 34,157 | 93,697 |

| 2040 | 63,010 | 30,688 | 93,698 |

| 2041 | 66,685 | 27,015 | 93,700 |

| 2042 | 70,565 | 23,128 | 93,693 |

| 2043 | 74,680 | 19,013 | 93,693 |

| 2044 | 79,040 | 14,658 | 93,698 |

| 2045 | 83,645 | 10,048 | 93,693 |

| 2046 | 88,530 | 5,167 | 93,697 |

| 2047 | - | - | - |

| TOTAL | $880,480 | $942,109 | $1,822,589 |