As recently as 2017, pension costs represented CPS’ greatest budgetary risk, as growing pension payments, shouldered almost entirely by Chicago taxpayers, diverted more funding each year from classrooms. Education funding reform passed that fall by the state of Illinois represented a significant step toward correcting the historical inequity that––unlike every other district in the state––burdened Chicago with the entirety of its teacher pension obligations. This change set in motion progress that reduced the district’s diversion of funds eligible to support classrooms from $676 million in FY2016 to $129 million in the FY2021 budget.

Two major changes at the state level are responsible for this progress, which greatly reduced the budgetary risk of the district’s pension obligations and put CPS on a path to pension funding stability. The first change involved the state providing funding for the district’s normal cost––the cost of annual increases to the district’s total liability––for teacher pensions. In FY2021, the state will provide $255 million for these costs. The second change was the state’s reinstitution into the property tax code, which gives the district the ability to levy a dedicated property tax to assist with the annual pension payments. Though this cost is covered by Chicago taxpayers, it will provide dedicated funding for teacher pensions in the amount of $490 million in FY2021, putting CPS in a vastly improved position to fund its pension liabilities without impacting funding distributed to schools.

COVID-19, however, represents a potential risk to the district’s financial position relative to its pension obligation going forward. While the full effect of COVID-19 on district finances as a whole and on pension costs more specifically, is yet to be determined, later in this chapter we discuss two significant ways in which COVID-19 could affect CPS’ pension burden going forward.

FY2021 also marks the second year that CPS will pay the City of Chicago $60 million annually for the city’s coverage of CPS employees participation in the Municipal Employees’ Annuity and Benefit Fund (MEABF) of Chicago. Before FY2020, the City assumed the entirety of the payment made on behalf of CPS non-teaching employees covered by the MEABF.

CPS remains the only school district in the state with its own teachers’ pension system, which is separate from the statewide Teachers’ Retirement System (TRS). CPS full-time salaried teachers and other licensed teaching staff are part of the Chicago Teachers’ Pension Fund (CTPF), which historically has been funded entirely by Chicago taxpayers with little support, until recently, from the state. Under this arrangement, Chicago taxpayers have faced the unique burden of having to support both the CTPF and the TRS. Like all other working Illinoisans, their income, corporate, and sales taxes paid to the state fund TRS costs, but Chicagoans alone support the CTPF through property taxes and other local revenue streams.

As part of education funding reform, the state has taken steps to address this long-standing inequity. Beginning in FY2018, the state has contributed funding in the amount of CPS teacher pension normal costs (i.e., the cost of the benefits that are projected to be created in the current year). In addition, the state reinstated a CPS teacher pension property tax levy in FY2017 that is appropriated exclusively for paying CTPF costs. For FY2021 and moving forward, a 0.567% maximum levy on the adjusted Equalized Assessed Value (EAV)1 of Chicago properties is dedicated to covering CPS’ statutory obligations to the CTPF.

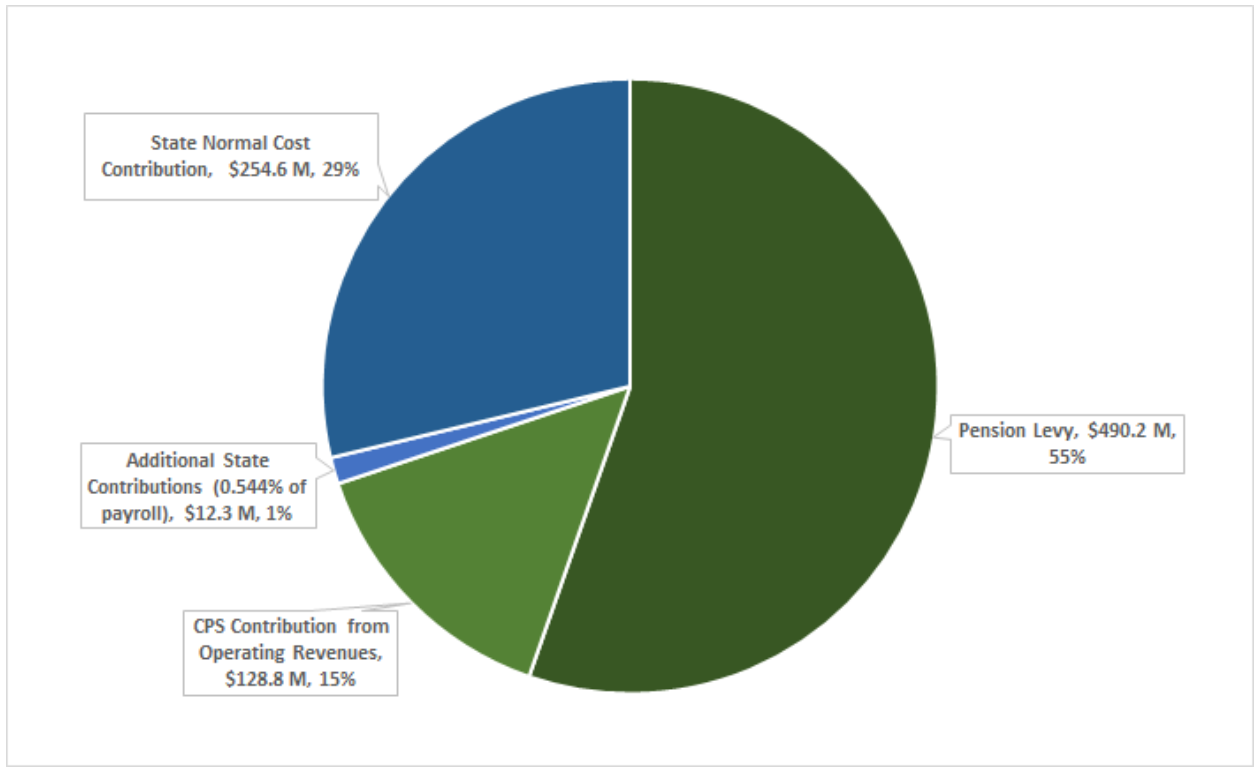

In FY2021, per the CTPF’s 2019 actuarial report2, the total required employer contribution to the CTPF will be $885,894,000. Of that number, the state will pay $266.9 million (comprising the projected normal cost and 0.544% of the CTPF’s total payroll, pursuant to Public Act 90-0655) and the reinstated pension property tax levy is projected to raise $490.2 million, assuming property tax payments are paid by August 29, 2021 at historical rates. Other operating revenues will contribute toward the remaining $128.8 million, as shown in Chart 1.

Chart 1: Projected FY2021 Funding for Required CTPF Employer Contributions

Compared to FY2020, the district will divert an additional $8.8 million from operating funds to cover the increase in pension costs. This increase in diversions is necessary because in FY2021, CPS will not benefit from a boost in total property value in Chicago, as properties are not subject to the triennial reassessment in that taxable year. More details on the breakdown of FY2021 employer costs can be found in the footnoted CTPF actuarial report.

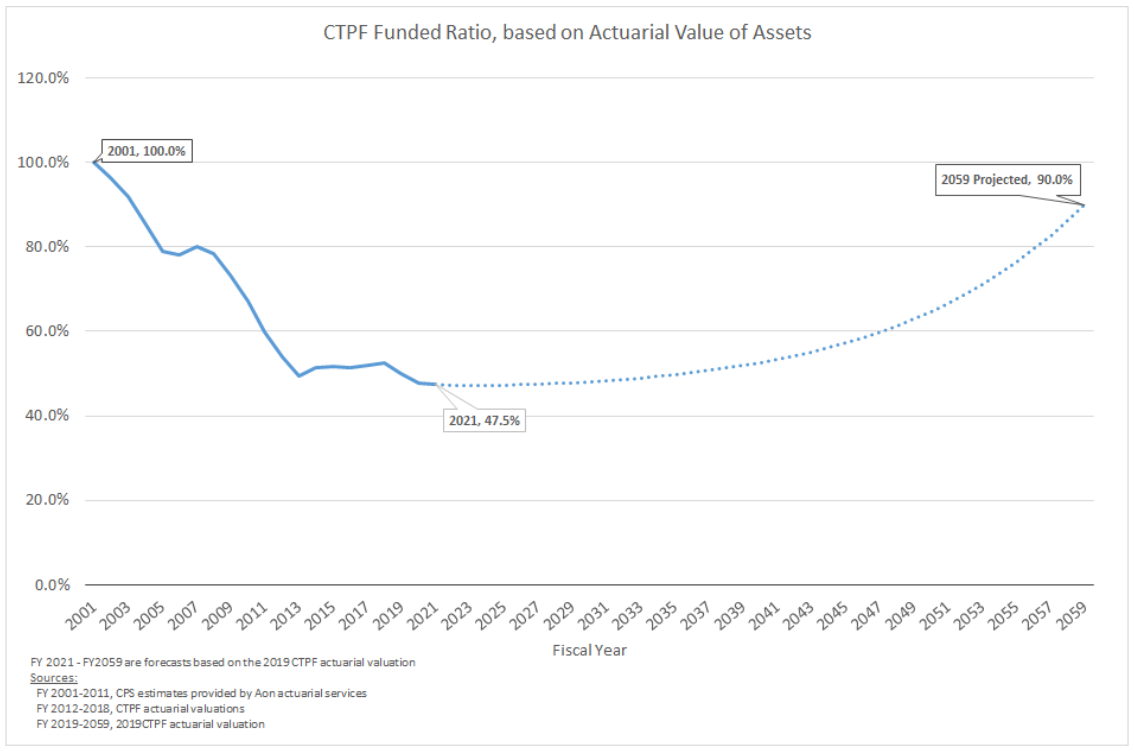

With these FY2021 payments, the funded ratio of the CTPF based on the actuarial value of assets declined to 47.40% in 2019, down from 47.85% from 2018. This decline is attributable to an unfavorable investment experience, with fund assets earning only 5.92% in 2019 compared to the investment return assumption of 7%. The unfunded actuarial accrued liability (UAAL) grew by $276 million to $12.2 billion.

There Remains a Large Disparity in how the TRS and CTPF are Funded by the State

The passage of state education funding reform in 2017 began to address a pension system that unfairly penalized Chicagoans.

Even though both the CTPF and TRS are governed by state statute, there has been a vast difference in the source of funding for both pension systems. The state of Illinois is projected to pay $266.9 million in FY2021 for CTPF teacher pension costs, which represents 30 percent of the total employer contribution. On the other hand, the state is projected to contribute $5,141 million toward the employer contribution to the TRS, which is 97 percent of the total employer contribution.3

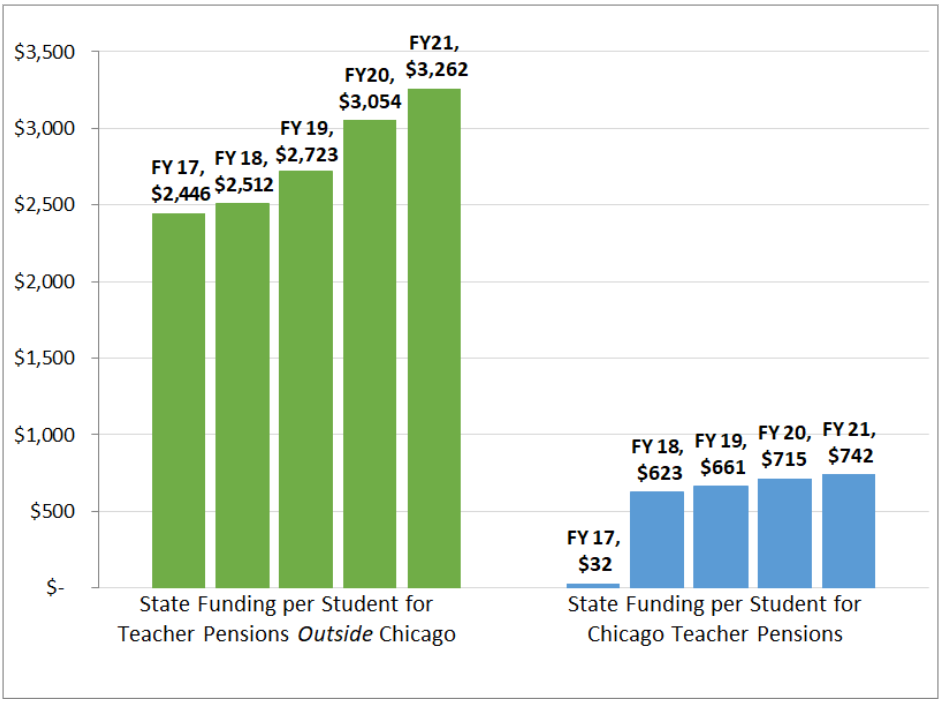

In FY2021, the state’s estimated contribution to TRS amounts to a pension contribution for downstate and suburban school districts of $3,262 per student, while CPS only received $742 per student (Chart 2). Before the state began to pick up the normal cost in FY2018, the disparity between Chicago and all other school districts in Illinois was significantly larger.

Chart 2: State Per-Pupil Contribution Disparity for Teacher Pension Funds

COVID-19 and the Future of CPS Pension Costs

COVID-19 could negatively impact CPS’ future pension costs in two primary ways. First, the wider economic fallout from the pandemic means that CTPF investments in equities, real estate, and other areas could fail to meet the seven percent investment return assumption in the year ending June 30, 2020. Fifty-nine percent of the CTPF’s investments as of June 30, 2019 were placed in U.S. and foreign equities, which were significantly impacted at the outset of COVID-19 but have since recovered to pre-COVID levels at the time of writing in August 2020. A further 8 percent were invested in Real Estate Investment Trusts (REITs) and other real estate holdings, and the magnitude of the impact that COVID-19 will have on these investments is yet to be determined.4 Any significant failure to meet the 7 percent investment return assumption could increase CPS’ pension obligation beginning in FY2022 and onwards.

A second way in which COVID-19 could negatively impact the amount of money that CPS has to divert from other operating costs comes with the decline in overall assessed value in Chicago. The pension levy is a flat 0.567% of all assessed value within the city, which means that any decline in assessed value will decrease the total revenue that flows to CPS. This is a revenue source that is responsive to property values, in contrast to the education property tax levy, which is capped to the rate of inflation. In the spring of 2020, the Cook County Assessor’s Office (CCAO) announced that all properties within the city would have “their property values [for Tax Year 2020] reviewed for estimated effects of COVID-19 following the appeal process.”5 The impact of any across-the-board adjustments to property values will only be reflected in property tax revenues collected in FY2022, and not in FY2021. The initial report for South Suburban properties, which underwent a reassessment process in FY2020, stated that the CCAO would decrease the assessments of single family homes by 10.3% and multi-family homes by 13.1% on average. This does not reflect the magnitude of the decline that might happen for Chicago reassessments, and the CCAO plans to release a supplemental report on COVID-19 and Chicago properties soon.

CPS’ Pension Contribution Requirements as an Employer

In FY2021, CPS is projected to contribute $619.0 million for Chicago pensions out of its own resources ($490 million of which comes from the property tax pension levy), with the state picking up the other $266.9 million. Of the $266.9 million in state funding, $254.6 million is for CTPF normal cost, and $12.3 million is for “additional” state contributions. These “additional” state contributions are statutorily required to offset the portion of the cost of benefit increases enacted under Public Act 90-0582 and are calculated as 0.544% of the Fund’s total teacher payroll.

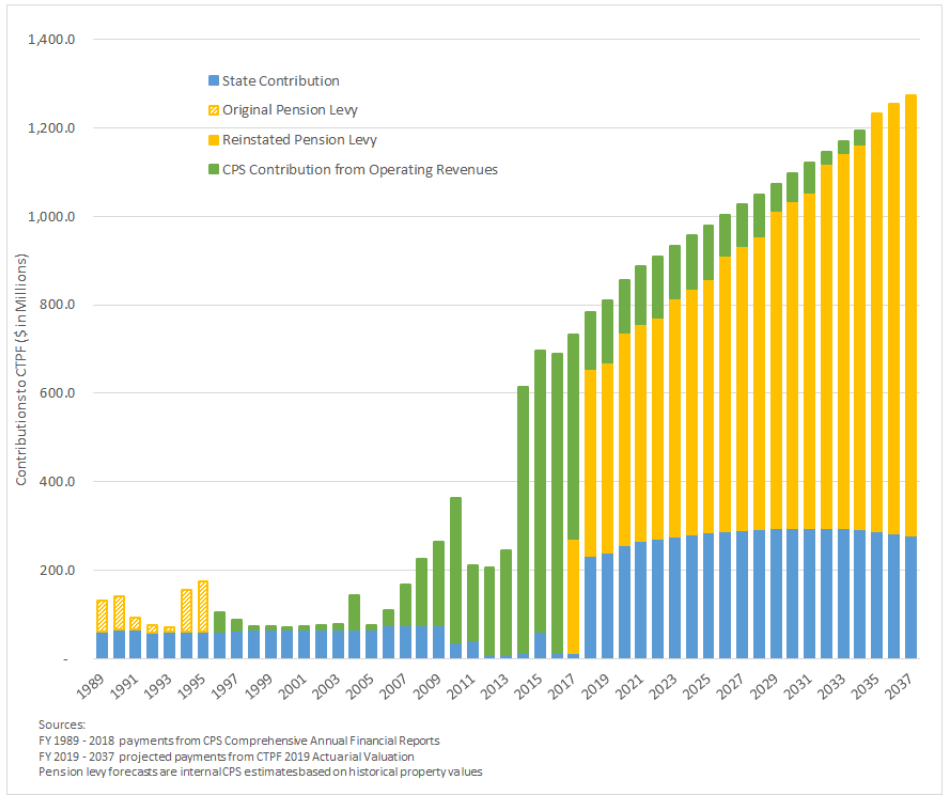

Revenues from the pension levy make up the majority of CPS’ contribution to the CTPF, estimated at $490.2 million in FY2021. The pension levy was reinstated in FY2017 as part of pension reform at an initial flat rate of 0.383% of Equalized Assessed Value (EAV), which increased to the current 0.567% rate in FY2018.

In FY2020, the flat 0.567% rate-limited levy worked out to a lower effective rate of 0.565% because the property tax code states that any rate-limited levy be applied to the prior year’s base property value and the current year’s new property value. Because Chicago’s valuations have increased slightly by 0.4% from Tax Year 2018 to 2019, relying on last year’s property values has the effect of driving down the effective tax rate from 0.567% to 0.565% of EAV. This creates a lag for the individual property owner, whereby a single-year increase in property tax value does not immediately translate into higher property tax costs, but instead only takes effect a year later. CPS will not be able to reap any benefits of the converse situation if property values decrease because the rate will be limited to 0.567% if the effective rate is greater than that value.

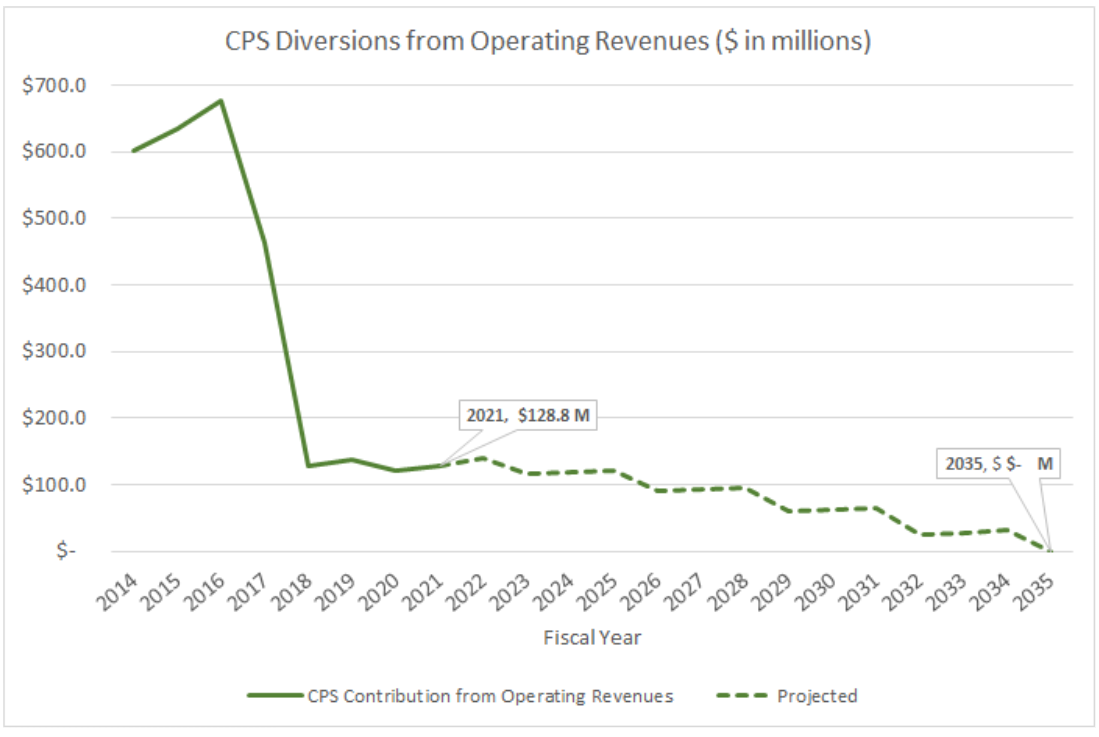

Chicago property values are projected to experience continued growth in the long-term after the fiscal effects of COVID-19 have abated, and as such the pension levy will generate more revenue in future fiscal years. This will decrease diversions from operating revenues that could otherwise be spent directly on investments in Chicago’s children. In FY2021, diversions from operating revenues are projected to grow slightly from an anticipated $120.0 million to $130.2 million.

Based on the CTPF’s 2019 actuarial report, and an assumption of approximately 8% growth in property values in assessment years and 2% growth in non-assessment years, CPS is on track to have no diversions from other operating revenues by FY2035. Although this represents an improvement from recent years, during which diversions from operating revenues peaked at $676 million in FY2016, the costs associated with paying for CTPF contributions will continue to be significant for the foreseeable future.

Chart 3: Diversions from Operating Revenues are Projected to Continue until 2035

Pension Contributions by the State and by Individual Employees

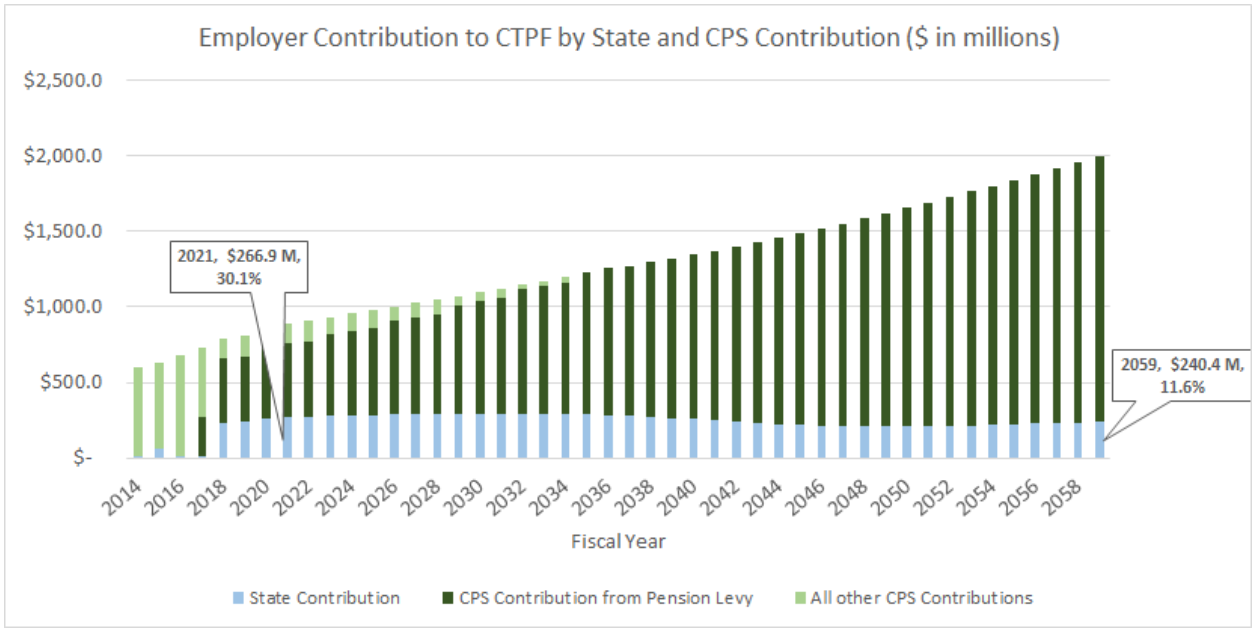

As the total employer contribution costs continue to increase in accordance with the actuarially required amount to reach a 90 percent funding ratio of CTPF by 2059, state contributions will shrink as a total share of the overall revenues used to cover this cost, if limited to just the normal cost and the “additional” 0.544 percent of payroll. In FY2021, the state’s contribution is projected to make up 30.1 percent of the total employer contribution, and this is scheduled to decline to 12 percent by 2059 if there is no further expansion of the CTPF’s employer cost assumed by the state. The normal cost borne by the state will gradually decline as a greater share of the workforce covered by CTPF comprises “Tier II” teachers who are entitled to a lower level of benefits. CPS is reliant on the state continuing to add funding to the Evidence Based Funding (EBF) model so that future pension costs do not prohibit us from investing in students and schools.

Chart 4: The State Share of CTPF Costs will Shrink in Future Years

At the individual level, employees covered by CTPF are required by statute to contribute 9% of their salary to pensions. However, from 1981 through 2017, CPS paid the first 7% on the employee’s behalf in addition to its own employer contribution. Under the 2020-24 Collective Bargaining Agreement with the Chicago Teachers Union, CPS no longer pays 7% for “Tier II” employees hired on or after January 1, 2017.

Decline in Funded Ratio Led to Increased CPS Contributions

Until June 30, 2001, CTPF had a funded ratio of 100%, and according to state law, CPS did not have to make an employer contribution. By June 30, 2004, the funded ratio had dropped to 86%, below a 90% threshold, and therefore CPS was statutorily required to make employer contributions beginning in 2006.

Chart 5: CTPF Funded Ratio Has Generally Decreased Since Early 2000s (Actuarial Value of Assets)

For the FY2019 CTPF valuation, the fund was negatively impacted by an approximate return on actuarial value of assets of 5.92 percent, lower than the assumed rate of return of 7.00%. As such, the certified CPS employer contributions for FY2021 is $619.0 million, $4.4 million higher than the prior year’s FY2021 projection of $614.6 million, reflecting an increase in the actuarial accrued liability of the CTPF by $329 million.

CPS’ Pension Contributions Continue to Grow

Pension contribution costs borne by CPS will continue to grow until 2059, with the majority covered by the pension levy. The state’s assumption of the normal cost since FY2017 will not fully fund the rising total costs of pension contributions because the normal cost is projected to decline as a share of the total employer cost. The pension levy, if assumed to stay flat at 0.567% of a property’s value, should eventually help pay for CPS’ entire share of the pension costs. However, long-term fiscal stability is still predicated upon the state lessening the tax burden placed on Chicagoans by fully funding the EBF model, which will provide additional resources to CPS and other school districts that primarily educate low-income students. More discussion on the state’s EBF formula can be found in the Revenue chapter of the Budget Book.

Chart 6: CPS Employer Pension Contributions Will Continue to Grow Every Year, With the Majority Covered by the Reinstated Pension Levy

MEABF Contributions

FY2020 was the first year that CPS absorbed some of the costs associated with its non-teaching employees covered by the Municipal Employees’ Annuity and Benefit Fund (MEABF). Prior to FY2020, the City of Chicago absorbed the entire cost of the MEABF employer contribution. As part of an Inter-Governmental Agreement (IGA) with the City of Chicago, the Board of Education paid $60 million to the city in FY2020, to fund obligations for the 17,146 CPS employees who are active members of the MEABF.

- Per 105 ILCS 5/34-53 and 35 ILCS 200/18-45, CPS has the ability to tax up to a 0.567% levy on the prior year’s taxable non-TIF base property, and the current year’s taxable non-TIF new property.

- https://www.ctpf.org/sites/files/2020-10/ctpf_val_2019_final_2.pdf

- https://www.trsil.org/sites/default/files/documents/TRS_Annual-Actuarial-Valuation_Final.pdf, page 31

- 2019 CTPF Actuarial Valuation, page 34

- https://www.cookcountyassessor.com/news/changes-assessments-and-appeals-due-covid-19