The effect of COVID-19 and the resulting economic downturn have impacted municipalities and school districts across the country, most significantly through reduced revenues, new expenses and uncertainty about the coming years. Though not insulated from the economic effect of the global pandemic, CPS’ improved financial position and stable revenue base — bolstered by additional federal relief dollars — has given the district the ability to maintain a strong budget in FY2021 and to combat broader economic uncertainty in the coming years.

As of the time of writing in early August 2020, the federal government has passed one COVID-19 financial relief package that directly disburses money to CPS. To impart budget relief and cover new expenses related to COVID-19, Public Law 116-1361 will provide CPS with $206 million through the Elementary and Secondary School Emergency Relief Fund (ESSER), part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act):2 $78 million will be for associated costs incurred in FY2020 and $128 million for costs that will be incurred in FY2021. Absent further federal aid, CPS projects that it will receive $6,894 million of operating revenues in FY2021, an increase of $631 million compared to the FY2020 budget. Much of this increased revenue comes from federal COVID-19-related funding and property taxes.

This growth in local and federal revenues for FY2021 puts CPS in a position to weather the profound impact COVID-19 has had on the state revenues, which CPS is set to receive this fiscal year. Per the June 2020 Commission on Government Forecasting and Accountability (COGFA) monthly briefing to the Illinois General Assembly3, the state of Illinois suffered a revenue loss of $1.838 billion, or 4.8 percent in FY2020 compared to FY2019 actuals, with corporate income taxes declining by a notable 14.2 percent. It is still too early to accurately predict how the state will recover economically in FY2021, and the FY2021 state budget (Public Act 101-06374) held Evidence-Based Funding (EBF) appropriations flat to FY2020 levels on a nominal basis. This denies CPS approximately $60 to $65 million of additional funding it would have received if statewide EBF matched the statutory Minimum Funding Level of $350 million. The state budget does not account for the possibility that Congress passes another aid package that provides federal funds to Illinois. Overall, CPS is set to receive a modest increase of $57 million in state revenues in FY2021, largely due to increased pension support for the Chicago Teachers’ Pension Fund (CTPF), carryovers of FY2020 revenue due to COVID-19-related underspend, and additional funding for capital projects. This increase pales in comparison to FY2020, where budgeted state revenues increased by $89 million compared to FY2019.

Local revenue sources are negatively impacted by COVID-19 to a smaller extent in FY2021. Local property tax revenues are projected to increase by $130 million in FY2021 relative to the FY2020 budget, representing a pace similar to the long-term trend of an annual 3 percent increase in non-reassessment years, slightly higher than the rate of inflation. Aside from a delay in the timing of receipt, there is no projected budgetary impact from Cook County Ordinance 20-24795 that waives penalties for any second installment property tax bill that is paid sixty days after the August 2, 2020 deadline, as second installment property tax revenues received after the revenue recognition deadline of August 29, 2020 will be recorded as FY2020 revenue. Additionally, the Cook County Assessor’s stated intention to apply a COVID-19 downward adjustment to all properties in Tax Year 20206 will only impact pension levy revenues in FY2022, and will not be felt in any levy in FY2021 because property tax bills are sent and paid one year in arrears.

While revenue generation from property taxes is not significantly impaired in FY2021, CPS faces some property tax challenges in the near future. Alongside the COVID-19-related decline in assessments from the Cook County Assessor’s Office which will impact pension levy revenues, there would be a potential impact if the pace of new construction slows from current trends. In line with the statewide decline in corporate income tax revenues, Personal Property Replacement Tax (PPRT) revenues are budgeted to decline by $20 million compared to the FY2020 budget.

In FY2020 and FY2021, CPS will receive the $206 million in ESSER funding that was appropriated in March 2020 as part of the CARES Act to cover new COVID-19-related expenses. This money flows down to school districts through the Illinois State Board of Education (lSBE) and will be supplemented by a limited statewide pot of $50 million, known as the Governor’s Emergency Education Relief (GEER), that will be distributed to districts for the purchase of technology tools and to provide home internet access to students.7 $18.5 to $28.7 million of this $206 million is projected to be distributed to non-public schools under the Interim Final Rule published by the U.S. Department of Education8 — which is effective immediately but is currently being challenged by CPS and Attorneys General in several states, including Michigan, California, and Wisconsin, in the United States Court of Appeals for the Ninth Circuit.9 The range reflects the various options presented under the Interim Final Rule, which stipulates that ESSER funds can either serve only the 89 percent of CPS schools that are Title I eligible or, in order to direct funds to all CPS schools, must be distributed to non-public schools based on their total enrollment of students. An additional share of this funding will support CPS’ charter and contract schools.

Given the shortfalls in anticipated increases in revenue from local and state sources, further appropriations of federal aid to school districts will be critical in helping CPS successfully reopen in the 2020-21 school year. At the time of publication, pending federal legislation is anticipated to provide significant school reopening and stabilization funding for K–12 districts around the country. The final amount that CPS will receive in total is yet to be determined, but CPS is anticipating $343 million in funding to support the FY2021 budget, a conservative figure based on the proposals being exchanged by both political parties in Washington, D.C., that also includes diversions to non-public schools.

This funding looks likely to materialize given the extensive negotiations that have already occurred between Congress and the President thus far. In May 2020, the U.S. House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions Act (H.R. 6800)10, an aid package that would provide a projected more than $900 million to CPS. This was followed by a package of bills released by the Republican Senate majority leadership in late July 2020, which would provide a similar amount of funding for CPS to the House legislation, though this funding would be contingent on at least a partial physical reopening of schools in the fall.11 At time of writing at the beginning of August 2020, it looks likely that Congress will pass a funding package that will have K–12 districts around the nation receiving substantial amounts of stabilization money in FY2021.

The greatest revenue challenge that CPS will face in the near future is the state’s ability to fully fund the EBF formula. According to ISBE’s own formula from FY2020, CPS will require another $1,924 million in funding in order to adequately and fully fund our schools, a gap that will have grown because of the state’s failure to meet the statewide Minimum Funding Level. When the EBF funding structure was passed in FY2018, the state committed to fully funding the formula by June 30, 2027, 10 years after its implementation. COVID-19 makes that already remote possibility even more unlikely. Before the passage of this FY2021 state budget, analysis by the Center for Tax and Budget Accountability (CTBA) showed that the state would need to increase statewide funding of EBF by $843 million per year in order to meet its commitment to fully fund the formula, much more than the Minimum Funding Level.12 It is critical that state lawmakers work toward fully funding the EBF formula to protect the hard-earned improvements to equity in education funding that happened prior to FY2021.

| FY2020 Budget |

FY2020 Projected End of Year |

FY2021 Budget |

FY2021 vs. FY2020 Budget |

|

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $3,134.5 | $3,150.3 | $3,264.9 | $130.4 |

| Replacement Tax | $215.3 | $202.5 | $194.9 | ($20.4) |

| Other Local | $600.8 | $567.7 | $570.9 | ($29.9) |

| Total Local | $3,950.6 | $3,920.5 | $4,030.8 | $80.2 |

| State Revenues | ||||

| EBF | $1,673.7 | $1,665.8 | $1,665.8 | ($8.0) |

| Capital | $32.4 | $32.4 | $47.3 | $14.9 |

| Other State | $575.6 | $565.3 | $625.7 | $50.0 |

| Total State | $2,281.8 | $2,263.5 | $2,338.7 | $56.9 |

| Federal | $767.5 | $775.5 | $1,336.7 | $569.1 |

| Investment Income | $5.0 | $4.2 | $0.5 | ($4.5) |

| Total Revenue | $7,004.9 | $6,963.6 | $7,706.6 | $701.7 |

Table 2 illustrates how CPS revenues are distributed into operating, debt service, and capital funds. Although the total revenues are $7,707 million in FY2021, only $6,894 million are available for operations.

| Total | Amount for Debt Service |

Amount for Capital |

Balance for Operating Budget |

|

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $3,264.9 | $55.7 | $5.3 | $3,204.0 |

| Replacement Tax | $194.9 | $39.4 | $0.0 | $155.5 |

| Other Local | $570.9 | $142.3 | $42.2 | $386.5 |

| Total Local | $4,030.8 | $237.4 | $47.4 | $3,745.9 |

| State Revenues | ||||

| EBF | $1,665.8 | $445.6 | $0.0 | $1,220.1 |

| Capital | $47.3 | $0.0 | $47.3 | $0.0 |

| Other State | $625.7 | $0.0 | $0.0 | $625.7 |

| Total State | $2,338.7 | $445.6 | $47.3 | $1,845.8 |

| Federal | $1,336.7 | $24.8 | $10.1 | $1,301.8 |

| Investment Income | $0.5 | $0.0 | $0.0 | $0.5 |

| Total Revenue | $7,706.6 | $707.9 | $104.8 | $6,894.0 |

Revenue Projections

This section summarizes the district's major revenue sources and each source’s projected FY2021 revenue. Additional details about each revenue source is provided in the Interactive Budget on the CPS budget website: cps.edu/budget.

FY2021 operating revenues are budgeted at $6,894 million, an increase of $631 million from our FY2020 budget and $671 million more than our FY2020 estimated end-of-year operating revenues.

| FY2020 Operating Budget |

FY2020 Estimated End of Year |

Variance Estimated vs Budget |

FY2021 Operating Budget |

FY2021 vs. FY2020 Budget |

|

|---|---|---|---|---|---|

| Property Tax | $3,073.8 | $3,089.6 | $15.8 | $3,204.0 | $130.2 |

| Replacement Tax | $151.0 | $138.2 | ($12.8) | $155.5 | $4.5 |

| TIF Surplus | $163.1 | $163.1 | $0.0 | $96.9 | ($66.2) |

| All Other Local | $270.3 | $237.1 | ($33.2) | $289.6 | $19.3 |

| Total Local | $3,658.1 | $3,628.0 | ($30.1) | $3,745.9 | $87.8 |

| State | $1,610.1 | $1,591.8 | ($18.3) | $1,578.9 | ($31.2) |

| State Pension Support | $257.3 | $257.3 | $0.0 | $266.9 | $9.5 |

| Federal | $732.7 | $740.6 | $7.9 | $1,301.8 | $569.1 |

| Investment Income | $5.0 | $5.7 | $0.7 | $0.5 | ($4.5) |

| Total Revenue | $6,263.3 | $6,223.4 | ($39.8) | $6,894.0 | $630.7 |

Local Revenues

Property Taxes

CPS is projected to receive $3,265 million in property tax revenues in FY2021, which remains the district’s largest single revenue source. Property taxes will make up 46.5 percent of all operating revenues, down from 49.1 percent in FY2020. Of the total property tax revenue, $56 million is restricted for paying off Capital Improvement debt, $5 million is allocated to other capital needs, and $490 million is projected as revenue from the dedicated CTPF levy. This leaves $2,714 million left for all other operating costs, an increase of $117 million from the FY2020 budget. The property tax debt service budget is projected to increase modestly by $5 million from FY2020.

The $117 million increase in the operating budget for non-pension property tax revenues includes $66 million from increasing the education levy by the rate of inflation of 2.3 percent13, which is the announced national inflation rate as of December 2019; $20 million generated from the $609 million in new property that is projected to be included in the 2020 tax bill; $18 million generated from the $547 million in projected TIF District Expiries; and $13 million from the Red-Purple Modernization Phase One Transit Tax Increment Financing (Transit TIF).

FY2021’s increased budget for property taxes reflects the performance of a stable and dependable revenue source. Since 1994, CPS has been one of over 450 school districts in the state whose education levy is not primarily determined by property value, but instead by the total levy from the previous year. Under the Property Tax Extension Limitation Law (PTELL), increases in property tax extensions are limited to the lesser of five percent or to the national increase in inflation in the year preceding the levy year. The money that CPS raises from the education levy for FY2021 is therefore the final extension for FY2020, multiplied by the finalized December 2019 inflation rate of 2.3 percent.14 This inflation rate is slightly higher than the previous year’s rate of 1.9 percent. Additionally, properties within Chicago city limits are reassessed only every three years. With the last reassessment having happened in Tax Year 2018, tax bills that will go out to property owners in 2021 will reflect an identical property value to 2020’s bill, before any COVID-related adjustment imposed by the Cook County Assessor. PTELL and flat assessments therefore mean that for the property owner of a $250,000 home, their tax bill paid to the Board of Education will only increase by 2.2 percent from 2020, approximately $50 more.

However, despite the dependable underpinnings of this foundational funding source, CPS still faces five challenges regarding its property tax revenues because of COVID-19. These challenges will impact FY2021 revenues to some extent, but could present additional sources of risk in future years if they materialize.

1) Slowdown in property value growth

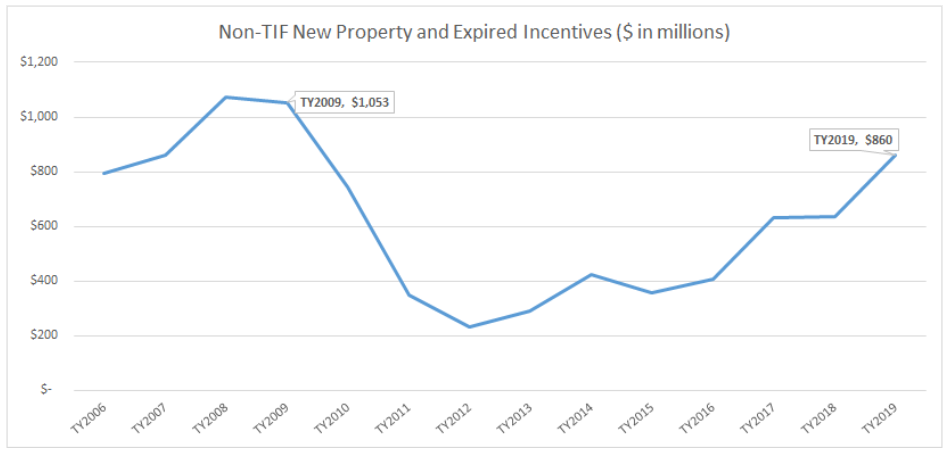

Because of PTELL, total revenues generated from CPS’ Education Levy are tied primarily to the rate of inflation. The exceptions to that rule include what is considered new property by the Cook County Clerk’s Office, which typically consists of the construction of new buildings that were not in the previous year’s tax rolls, and the expiry of the incremental value in TIF districts. In FY2020, there was $859.9 million of non-TIF new property, the highest value of new construction since 2009 and the continuation of a positive trend since the end of the housing crisis around FY2013. (Chart 1) FY2020 revenues generated from this new construction were approximately $26 million, and new property is the only way CPS can ever gain Education Levy revenues over the rate of inflation.

Chart 1: Non-TIF New Property in Chicago, Tax Years 2006-2019

The number of new permits issued in the first six months of 2020 declined by 21 percent compared to the equivalent time-frame in 2019, per data from the City of Chicago Department of Buildings.15 It is too early to tell if this represents a one-time slowdown reflecting fears around the spread of COVID-19, or whether it is a sign of a COVID-19 economic slowdown that systematically decreases demand for new construction in the real estate market. As a result, the FY2021 CPS Education Levy budget includes a new property assumption of $609 million, which would be the lowest level since 2017. This assumes a decline in new construction of 29 percent, which matches the single year decline from Tax Year 2009 to Tax Year 2010 in the previous large-scale recession. If new construction in the second half of 2020 recovers sufficiently to match 2019 annual levels, CPS would stand to receive an additional $9 million in FY2021 over the current budget.

2) Slowdown of inflation impacting Education Levy revenues in FY2022 and onwards

In FY2021, the rate of inflation of 2.3 percent is projected to make up 63 percent of revenue growth in the Education Levy. Per PTELL, the inflation rate used for FY2021 will match the national Consumer Price Index for All Urban Consumers (CPI-U) as of December 2019, released by the Bureau of Labor Statistics (BLS).16 A 2.3 percent annual growth in inflation was in line with the long-term trend of approximately two percent per year, but that is likely to be much lower in December 2020 because of the economic downturn associated with COVID-19.

As of the June 2020 CPI-U report, the annualized rate of inflation was only 0.6 percent17, a decrease from the long-term average of two percent that is driven primarily by sharp national declines in the prices for energy (13 percent decline, six percent of CPI-U total), apparel (seven percent decline, three percent of CPI-U total), and transportation (seven percent decline, five percent of CPI-U total). These declines offset increases in the price of food at home, which in May 2020 was at its highest level since January 2012.18

Because of the outsized role that inflation plays in increasing Education Levy revenues, this low level of inflation will have a profound impact on future revenues if it continues through December 2020 and beyond. Any decline in inflation in December 2020 will only be felt in FY2022 revenues because of the way that PTELL is implemented in Illinois. A 0.6 percent increase in CPI-U will drive FY2022 property tax revenues down by approximately $44 million.

3) COVID-19 adjustments from the Cook County Assessor

Chicago is not due for a reassessment of all properties within city limits until 2021, which will impact FY2022 revenues. Per the Property Tax Code (35 ILCS 200/9-155), the Cook County Assessor shall determine the value of a taxable property as of January 1 of that tax year. On January 1, 2020, the economic effects of COVID-19 were yet to be felt in Illinois.

Nevertheless, the Cook County Assessor’s Office announced in April 2020 that it would apply a COVID-19-related adjustment to properties throughout the county, including Chicago, without the need for property owners to appeal directly to the Assessor’s Office.19 Per the Assessor’s office, this downward adjustment in assessments is necessary because of the negative effect that increased unemployment and downturns in commercial and rental income have on real property values.20

As of the time of writing, the Assessor’s Office has not yet published the magnitude of the adjustment to Chicago properties. The only indication of how large this adjustment might be comes in the completed initial assessments for the South and West suburbs, which were up to be reassessed in 2020. On average, the Assessor’s Office announced that he was decreasing the assessments of these suburban single family homes by 10.3 percent, and multi-family homes by 13.1 percent, with the impact on non-commercial properties yet to be determined.

Assessor Fritz Kaegi has publicly committed to a platform of fairness, transparency, and ethics in assessments since his election in 201821, a laudable system of values that is good for the city as a whole. However, COVID-19 adjustments to properties do not meaningfully ease the property tax burden on individual Chicago residents, and they decrease the amount of money CPS is able to generate in pension levy revenues. The COVID-19 adjustments will only be reflected on tax bills that are received by taxpayers in June 2021, long after they will most urgently need the relief that a lowered tax bill can bring. Additionally, CPS’ pension levy, which is discussed at greater length in the Pensions chapter of the Budget Book, is the only major levy among all overlapping governmental units in the City of Chicago that is directly tied to the value of all properties within the city. Other large property tax levies are either subject to PTELL (e.g., CPS’ Education Levy) or are entirely at the discretion of the governmental body as a home rule unit, and are therefore not tied to changes in property value. Both the City of Chicago and Cook County have demonstrated a strong preference for keeping their property levy mostly constant from year to year.

If taxpayers saw a 10 percent COVID-19 downward adjustment, the relief it would bring to taxpayers in the summer of 2021 would be limited. The pension levy is a flat rate tax of 0.567 percent applied to the prior year’s base value and the current year’s new property value. Because of property growth from year to year, the pension levy had an effective rate of 0.565 percent in 2020.

If a 10 percent downward adjustment were applied to a homeowner of what would otherwise be a $250,000 home, they would see their tax bill go down by only $41, if all other taxing bodies held their total levies constant. The impact of a 10 percent decrease in assessments across the board would significantly impact CPS, with property tax revenues going down by $39 million in FY2022 alone. This decrease in revenue would require CPS to divert operating spending that could be used to directly support classrooms in order to meet our required employer contribution to the CTPF.

4) City and state government extensions of expiring TIF districts

The expiration of TIF districts provides the most unpredictable variation in CPS property tax revenues from the education levy each year. When a TIF district expires, any incremental value over the frozen value when the TIF district was first created counts as ‘new property,’ indistinguishable in its effects on CPS from other construction that happened in the current tax year. This effectively collects all new property value that was created within the TIF district over the span of the previous 23 years (the initial lifespan of all TIF districts, per state law) and releases it to CPS to access in a single year.

At the start of FY2020, there was approximately more than $1.4 billion of TIF districts that were projected to expire in FY2021. However, due to a mixture of several TIF district extensions passed in the Chicago City Council in April 202022, the extension of a large Near North Side TIF by the Illinois General Assembly in June 2020 in Public Act 101-064723, and the early retirements of portions of some districts, that amount of projected new property in the form of TIF expiries has significantly shrunk to a projected $547 million.

While the extension of TIF districts is a normal function of city and state government, and they are able to pass legislation that does so at their discretion, it is important for these sister governments to recognize the short-term harm that these extensions cause to PTELL-restricted governments like CPS. If CPS could count on additional $500 million in expiring TIFs in FY2021, it would be able to raise another $14 million in property tax revenue in FY2021.

5) Late payments of property taxes

In May 2020, the Cook County Board of Commissioners passed Ordinance 20-2479, which waives penalties for any second installment property Tax Year 2019 tax bill that is paid sixty days after the official deadline of August 2, 2020. This ordinance recognizes the financial harm that job losses, decreases in income, and increased medical costs, among other COVID-19-related effects, has on individual taxpayers, and gives them more time to pay the second installment of their property tax bills. This represents immediate financial relief for many Chicagoans who are currently struggling economically.

It is too early to determine how many taxpayers will take advantage of this county ordinance to pay their property tax bills after the current revenue recognition period of August 29, 2020. There is currently no indication that a similar policy will be put in place for Tax Year 2020, impacting the timing of FY2021 property tax revenues. Any taxpayers that default on their property tax payments will not deprive CPS of money in the long-term, given that these delinquent properties will thus be subject to the usual tax sale process conducted by the Cook County Treasurer.

Other Property Tax Considerations

A growing proportion of all CPS operating revenues is generated by the TIF district created for the Red-Purple Modernization Program (Transit TIF) on the North side of Chicago to modernize Chicago Transit Authority (CTA) tracks from North Avenue to Devon Avenue. By statute, CPS is due approximately 52 percent of all incremental value produced in the Transit TIF24, and per projections produced by the Cook County Clerk in 201925, CPS should generate $143 million in Transit TIF by 2030. CPS will benefit if property growth within the boundaries of the Transit TIF continues in future assessment years. In FY2021, CPS projects that Transit TIF revenues will be $79 million, $13 million more than FY2020. This is the consequence of a projected 4 percent increase in assessed values within the Transit TIF, higher than the citywide projection of 0 percent.

Personal Property Replacement Taxes (PPRT)

PPRT revenue underperformed its budgeted projection in FY2020, with actual revenues of $202 million falling short of the $215 million budgeted. This shortfall was entirely due to the economic effects related to COVID-19. Disbursements from August 2019 to April 2020 were $27 million above budget. However, those gains were erased by May disbursements which covered corporate income tax revenues earned by the state in April, with CPS recording a single month $35 million PPRT revenue shortfall.

PPRT revenue is budgeted to decrease from $215 million in FY2020 to $195 million in FY2020. This is driven by the state’s projections that anticipate a decline in the amount of corporate income tax revenue which they will collect. This economically-sensitive revenue source dropped by 14.2 percent in FY2020 compared to FY2019 actuals, per the state’s June estimates. There is a vast amount which is unknown about how COVID-19 will affect corporate income, including how quickly commercial and industrial activity will return to pre-pandemic levels, how quickly job losses are reversed, and whether there is robust federal intervention to prevent the economy from suffering a prolonged economic slowdown.

With those caveats, the state budget that was passed in May 2020 does not foresee corporate income tax revenue to continue falling at the same pace. Instead, it sees net corporate income taxes declining by 3.1 percent in FY2021. This forms the basis of CPS’ FY2021 PPRT budget of $195 million. This figure includes $39.4 million set aside for debt service and leaves $155.5 million for operating purposes, which is $4.5 million higher than FY2020. Debt service costs backed by PPRT are lower in FY2021 compared to FY2020 by $25 million.

Replacement taxes “replace” money that was lost by local governments when their powers to impose personal property taxes on corporations, partnerships, and other business entities were taken away by state legislation in the 1970s. The tax is currently imposed at a rate of 2.5 percent of federal taxable income for corporations, and 1.5 percent of federal taxable income for partnerships, trusts, and Subchapter S corporations.

The state collects and distributes PPRT to local taxing districts. Taxing districts in Cook County receive 51.7 percent of collections, which is divided among the county’s taxing bodies based on each district’s share of personal property collections in 1976. CPS receives 27.1 percent of the total Cook County share, which is equivalent to 14.0 percent of the statewide total.

The PPRT includes an additional state income tax on corporations and partnerships, a tax on businesses that sell gas or water, a 0.5 percent fee on all gross charges for telecommunications services excluding wireless services, and a per-kilowatt tax on electricity distributors. The primary driver of PPRT is corporate income tax receipts, which are closely tied to corporate profits.

A portion of the state’s total corporate income taxes are first deposited into a Refund Fund to pay business income tax refunds. The size of that portion is determined by the Illinois Department of Revenue (IDOR), based on the size of revenues and business demand for refunds. In FY2020, that refund rate was estimated at 14.25 percent of all corporate income tax collections, leaving the remaining 85.75 percent to be largely disbursed to local governments.26 This refund rate would be the lowest it has been in several years. The CPS FY2021 budget assumes that the refund rate is flat to FY2020’s estimate.

Though a relatively small portion of CPS’ total revenues, PPRT will continue to be a highly volatile revenue source that will be responsive to economic conditions within the state of Illinois.

TIF Surplus and Other Local Resources

CPS expects to receive $96.9 million in TIF surplus funding in FY2021, which is lower than the $163.1 million that CPS budgeted for in FY2020. The FY2020 TIF surplus was the most that CPS has ever received and is a product of the $300 million overall TIF surplus declared by Mayor Lori E. Lightfoot–– the largest in Chicago history. This large citywide TIF surplus declaration was part of the Amended Budget that CPS passed in November 2019 following the successful conclusion of contract negotiations with the Chicago Teachers’ Union and the Service Employees International Union Local 73. This was a single year action, and FY2021 TIF surplus revenues are likely to revert to the FY2019 level of $96.9 million.

TIF surpluses are one-time actions that, when declared, allow for accumulated reserves to be distributed to local governments on a proportional basis. Per Executive Order 2013-3, which is still active, the City of Chicago is committed to declaring a TIF surplus in districts that are older than three years, were not created for a single redevelopment project, do not support debt service costs on Modern Schools Across Chicago (MSAC) bonds, and have a balance of at least $1 million.

“All other local” revenue includes the pension payment made by the City of Chicago on behalf of CPS for their employer contribution to the Municipal Employees’ Annuity and Benefit Fund (MEABF), which is estimated to be $124 million in FY2021. This is a non-cash revenue. FY2021 marks the second year that CPS is absorbing some of the pension costs of its non-teaching staff. Prior to FY2020, the City of Chicago paid CPS’ entire MEABF employer contribution, but CPS now bears $60 million of that cost to offset the city’s contribution on behalf of CPS employees. More discussion of this revenue stream is found in the Pensions chapter of the Budget Book.

Local Contributions to Capital

FY2021 local capital revenue of $47.4 million includes $38.7 million in TIF-related project reimbursements and $8.8 million from other local funding sources such as aldermanic menu funds and the water reclamation district.

State Revenue

In FY2021, $1.85 billion in state funding will comprise 26.8 percent of CPS’ total operating budget. The majority of that figure comes from the statewide EBF model which, beginning in FY2018, has been used to disburse money based on need to each school district in the state of Illinois.

FY2021’s state operating budget is $22 million lower than FY2020. $8 million of this decline is attributable to EBF being both held flat to FY2020 levels for all districts statewide and CPS slightly underperforming its budget in FY2020. The majority of the remainder is because there is more debt being backed by EBF funds. Overall, state funding being held flat from FY2020 is detrimental to outcomes at CPS because EBF was designed to allocate an additional $60 to $65 million to CPS each year to shrink the historic state underfunding of school districts in Illinois. The ‘adequacy gap’ which measures the extent of that inadequate funding is therefore likely to be higher than the FY2020 figure of $1,924 million.

This failure to increase K–12 funding is a symptom of the wider fiscal crisis that Illinois currently confronts, being the first state to pass a state budget by borrowing from the Federal Reserve’s Municipal Liquidity Facility. In some senses, however, a statewide K–12 budget being held flat to FY2020 levels is the best case scenario. FY2021 education budgets for states around the country were cut, ranging from a $300 million cut concentrated on wealthier districts in Ohio to a $716.9 million cut in New York that was equally applied to all districts.27 Though short of what was previously expected, CPS lauds the state for maintaining the level of EBF disbursement despite its own fiscal hardship.

There is no state government in the United States that does not currently confront historic declines in income and corporate tax revenue because of COVID-19, and increases to state funding of any appropriation in Illinois would have been difficult given the huge structural deficits the state is grappling with in the midst of the global pandemic. Yet, if the state is to fulfill its commitment at the outset of EBF’s enactment to fully fund K–12 funding by FY2028, it will be critically important that increased funding be restored to EBF beginning in the FY2022 budget.

Much of the state’s ability to fund future EBF increases is contingent on the successful passage of a popular referendum to ratify a constitutional amendment that allows for a graduated income tax structure in November 2020 (Public Act 101-0008). Currently, income tax in Illinois is governed by a flat rate of 4.95% for individuals, no matter their level of income in that year. The constitutional amendment would raise state tax rates only for individuals and joint filers who earn more than $250,000, bringing Illinois in line with almost all of its Midwestern neighboring states. The Governor’s initial budget proposal in February held back $150 million in EBF funding contingent on the passage of the graduated income tax referendum. The failure to implement this constitutional amendment would make it much harder for the state to live up to its EBF funding commitments.

The state supplements the EBF disbursement with categorical grants that support specific initiatives within school districts, including transportation and early childhood education. Those categorical grants were also by and large held flat to FY2020 budgets in the FY2021 state budget. The other large component of state funding comes from their funding of the normal cost as part of the annual employer contribution to the CTPF, which is discussed in further detail in the Pensions chapter.

Evidence-Based Funding

The EBF model of state education funding is now in its fourth year of implementation, replacing the old General State Aid (GSA) formula. While the EBF model has contributed to CPS’ improved financial standing over the past few years, it still does not sufficiently close the district’s deficit, even if CPS were to receive its anticipated increase in funding — which will now not materialize in FY2021.

In FY2021, CPS projects that it will receive a total of $1,649 million in EBF money from the state, $8 million lower than FY2020. There is no increase in tier money from the state budget in FY2020, and diversions from state funding to fund seven charter schools authorized by ISBE are projected to increase by $8 million.28 This $8 million decline in revenue adjusts EBF funding to match the actual level of diversion in FY2020 and was the sole cause of EBF actual revenues in FY2020 being $8 million lower than what was budgeted.

Of the $1,649 million, $446 million will be used to back debt service issuances, $64 million higher than FY2020. CPS also projects to receive $16.3 million in adjustments to prior year EBF and GSA revenues. This annual surplus is due to the loss in state aid revenues that CPS suffered in prior years because of an under-estimation of prior year property values.

CPS will receive only the FY2020 EBF allocation as the current year Base Funding Minimum (BFM). Any money appropriated over the BFM is referred to as tier money, as it is distributed according to a district’s standing in one of four tiers. CPS will remain a Tier 1 district, the neediest in the state, and would typically receive funding that is equal to half of all new funding. In FY2021, it will receive no tier funding.

Since the implementation of EBF in FY2018, CPS has remained a Tier 1 district. These four tiers are determined based on the percentage of an Adequacy Target that a school district is able to fulfill with local resources in a given fiscal year. Adequacy Targets are determined by the cost of providing each student with core investments such as teachers, guidance counselors, nurses, and librarians, and account for additional support for limited-income students, English Learners, and students with disabilities. CPS had a FY2020 Adequacy Target of $5.586 billion, equivalent to $15,531 of spending per student.

However, with current levels of resources, which combine the BFM, operating revenue from property taxes, and PPRT revenue, CPS only met $3.663 billion of that $5.586 billion target—or 65.6 percent adequacy. CPS remained a Tier 1 district in FY2020 because its adequacy percentage was lower than the 67.4 percent threshold delineating Tier 1 and Tier 2 districts.

The $1,649 million that CPS will receive in EBF in FY2021 is insufficient to fully fund CPS’ activity to the level the state recommends. CPS required an additional $1.924 billion annually from the state to fully fund the investments that Chicago’s children deserve, equivalent to $5,348 per student. CPS supports any future efforts from the Governor and state legislative leaders to accelerate investments to fully fund the EBF model as quickly as possible.

Categorical Grants

CPS will receive approximately 20 categorical grants from the state in FY2021, totaling approximately $359 million in operating funds, $40 million more than FY2020. The majority of this revenue is earmarked for early childhood education, which will be worth $238.4 million, $37 million higher than FY2020 levels, and which constitutes the vast majority of the increase in categorical grant funding compared to FY2020. This represents only a carryover of unspent FY2020 funds, as spending on early childhood education was lowered due to COVID-19. The actual early childhood state appropriation for FY2021 is flat to FY2020. The remainder, totaling $120.4 million, will pay for Students with Disabilities' tuition costs, transportation, after—school programming, and nutrition, among other activities.

These other grant revenues will slightly increase largely because of increased state appropriations to pay for special education costs for children in orphanages and foster care facilities as per 105 ILCS 5/14-7.03, the only categorical revenue stream that saw an increase from FY2020 levels. All other categorical state revenue streams were held flat from the FY2020 state budget, and all other variations are attributable to FY2020 actual revenues diverging from FY2020 budgeted levels.

State Contribution for Capital

The state revenue total of $47.3 million comprises $13.3 million in gaming revenue for new construction projects, and $34 million in other potential state grants.

Federal Revenues

Most federal grants require the Chicago Board of Education to provide supplemental educational services for children from low—income households, children from non—English speaking families, and for neglected and delinquent children from preschool through twelfth grade. These grants are dedicated to specific purposes and cannot supplant local programs. Medicaid reimbursement and Impact Aid are the only federal funding that is without any restriction.

Every Student Succeeds Act (ESSA) (previously known as No Child Left Behind)

- Title I-A—Low Income: Allocated based on a district’s poverty levels, this is the largest grant received under the ESSA. The grant allows the district to provide supplemental programs to improve the academic achievement of low-income students. CPS estimates that the district will receive $222.5 million in Title I funding in FY2021. This includes an anticipated reduction of $5.7 million in the formula-based Title I grant from FY2020 to FY2021. The anticipated total grant award for FY2021 is $252.5 million, which includes allowable carryover of $30 million from the previous year.

- Title I-A—IL Empower: This grant is a state-wide system of differentiated support and accountability to improve student learning, purposely designed to develop capacity to meet student needs. CPS anticipates a grant award of $26.1 million in FY2021, which includes a carryover of $11.7 million from the previous year.

- Title I-D—Neglected/Delinquent: This grant targets the educational services for neglected or delinquent children and youth in local and state institutions to assist them in attaining state academic achievement standards. Programs include academic tutoring, counseling, and other curricular activities. The anticipated total grant award for FY2021 is $2.1 million, which includes allowable carryover of $789,000 from the previous year.

- Title II-A—Improving Teacher Quality: This grant funds class size reduction, recruitment and training, mentoring, and other support services to improve teacher quality. CPS anticipates a total of $25.9 million to be awarded for the FY2021 Title II-A grant, which includes a current award of $17.7 million and an estimated $8 million in carryover from the previous year.

- Title III-A—Language Acquisition:These funds support students with limited English proficiency who meet eligibility requirements. The total funding available is estimated at $8 million for FY2021, which does not include carryover from the previous year.

- Title IV-A—Student Support and Academic Enrichment Grants: These grants support states, local educational agencies, schools, and local communities to provide all students with access to a well-rounded education, improved student learning conditions in schools, and increased technology in order to improve the academic achievement and digital literacy of all students. CPS anticipates a total of $28.3 million to be awarded for the FY2021 Title IV-A grant, which includes a carryover of $10.8 million from the previous year.

- Title IV-B—21st Century Community Learning Centers: These grants provide opportunities for communities to establish schools as community learning centers and provide activities during after-school and evening hours. CPS estimates level grant funding of $9.4 million in FY2021.

- Title VII-A—Indian Education: Funds from this grant are used to meet the educational and cultural needs of American Indian and Alaska Native students. The grant award is expected to stay level at $229,367 for FY2021.

Individuals with Disabilities Education Act (IDEA)

IDEA grants are allocated based on a state-established formula to provide supplemental funds for special education and related services to all children with disabilities from ages three through 21.

The IDEA grants include a number of programs:

- IDEA Part B Flow-Through: This is the largest IDEA grant, with the estimated award for FY2021 totaling $103 million, which includes $13 million in carryover funding from FY2020.

- IDEA Room and Board: This grant provides room and board reimbursement for students attending facilities outside of Chicago and is estimated at $2.5 million in FY2021.

- Part B Preschool: This grant offers both formula and competitive grants for special education programs for children ages 3–5 with disabilities. CPS is expected to stay level at $1.3 million from the formula grant and $489,250 from a competitive grant for FY2021.

Total FY2021 IDEA funding equals $107 million, including small competitive grants and carryover from the previous year in the preschool grant.

National School Lunch Program & Child and Adult Care Food Program

CPS offers free breakfast, lunch, after-school supper, after-school snacks, Saturday breakfast and lunch, and Head Start snacks for afternoon classes during the school year. The district also serves breakfast and lunch during summer school.

In 2012, CPS began participating in the Community Eligibility Provision program. All schools now are part of this program, which provides all students a free lunch regardless of income eligibility. CPS is reimbursed for all lunch meals at the maximum free reimbursement rate under the National School Lunch Program.

CPS’ school breakfast programs provide breakfast in the classroom free of charge to all students regardless of income.

In addition, the USDA reimburses CPS for free after-school supper through the Child and Adult Care Food Program. The nutrition department also takes advantage of the donated commodities program.

CPS anticipates $245 million in federal reimbursements for FY2021. These revenues include:

- $197 million for school lunches, breakfast, snacks, and donated foods

- $38 million for summer food service program

- $9.3 million for after-school meals

Medicaid Reimbursement

Local Education Agencies (LEAs) are required to provide special education and related services as delineated in the Individualized Education Program (IEP) or Individualized Family Service Plan (IFSP) at no cost to parents. Medicaid provides reimbursement for the:

- Delivery of covered direct medical services provided to eligible children who have disabilities in accordance with the Individuals with Disabilities Education Act (IDEA), as outlined in the student’s IEP; and the

- Cost of specific administrative activities, including outreach activities designed to ensure that students have access to Medicaid-covered programs and services.

Medicaid provides reimbursement for covered direct medical services including audiology, developmental assessments, medical equipment, medical services, medical supplies, medication administration, nursing services, occupational therapy, physical therapy, psychological services, school health aide, social work, speech/language pathology, and transportation. When these services are provided to Medicaid enrolled students with IEPs, the services are eligible for Medicaid reimbursement at the state’s reimbursement rate, approximately half of the established cost to provide the service.

Medicaid revenues in FY2021 are projected to be $29 million, subject to the level of health care services rendered in the upcoming school year. FY2021 Medicaid revenues are strengthened by continued revenue retention initiatives focused on enrolling eligible students in Medicaid, improving service capture, maximizing claiming and billing processes, and ensuring all claimable costs are reimbursed. New initiatives include strengthening operational practices and controls at non-public schools, supporting school administrators to standardize paraprofessional service capture processes and approvals, and intensifying the review of failed and denied claims by ensuring all providers that order, refer, and/or prescribe specific services to be rendered to CPS students have met all Medicaid billing requirements.

Other Federal Grants

This category includes competitive grants for other specific purposes, including:

- Carl D. Perkins: This grant was established to help students in secondary and post-secondary education develop academic and technical skills for career opportunities, specific job training, and occupational retraining. The FY2021 Perkins formula grant is anticipated to be $6.5 million, which includes an estimated rollover of $905,826.

- E-rate: The Federal Communications Commission provides funding through its E-rate program to discount the cost of telecommunications, internet access, and internal connections for schools and libraries across the country. In FY2021, CPS expects to receive $4.2 million of federal E-rate money to reimburse IT projects.

Federal Contribution for Capital

Federal contributions to the capital budget are expected to be $10.1 million; these contributions are driven by spending on E-rate eligible upgrades to the district’s IT infrastructure.

Federal Interest Subsidy under Qualified School Construction Bonds (QSCBs) and Build America Bonds (BABs)

In FY2021, CPS has budgeted to receive a direct federal subsidy payment of $25 million for these two types of federally-subsidized bonds. This amount takes into consideration an allowance assumption of 5.9 percent for federal sequestration, down from 6.2 percent in our FY2020 assumptions. See the Debt Management chapter for more information.

- https://www.congress.gov/bill/116th-congress/house-bill/748

- https://www.isbe.net/Documents/CARES-Act-District-Info-3-31-20.pdf

- https://cgfa.ilga.gov/Upload/0620revenue.pdf

- https://www.ilga.gov/legislation/publicacts/fulltext.asp?Name=101-0637

- https://cook-county.legistar.com/LegislationDetail.aspx?ID=4537409&GUID=077A0BF7-776B-4230-BFAF-3275777326CE&Options=Advanced&Search=

- https://www.cookcountyassessor.com/news/changes-assessments-and-appeals-due-covid-19

- https://www.isbe.net/Pages/Educational-Technology.aspx

- https://www.eseanetwork.org/news-and-resources/blogs/used/secretary-devos-issues-rule-to-ensure-cares-act-funding-serves-all-students

- https://oag.ca.gov/system/files/attachments/press-docs/CARES%20Act%20K-12%20Funds%20Complaint.pdf

- https://www.congress.gov/bill/116th-congress/house-bill/680

- https://documentcloud.adobe.com/link/track?uri=urn:aaid:scds:US:333e0079-0c5a-483b-93d0-d2afacce7a96#pageNum=101

- https://www.ctbaonline.org/reports/impact-underfunding-evidence-based-funding-formula, page 2

- The growth in a taxing district’s aggregate extension base (sum of all extensions for funds subject to the PTELL) is limited to five percent or the rate of inflation, whichever is less. The inflationary increase is equal to the percentage change in the Consumer Price Index (CPI) from the prior year and is called the “limitation.” The CPI used is the national CPI for all urban consumers (CPI-U) for all items as published by the United States Department of Labor, Bureau of Labor Statistics. The December 2019 CPI-U, which impacts FY2021, was 2.1 percent.

- https://www2.illinois.gov/rev/localgovernments/property/Documents/cpihistory.pdf

- https://data.cityofchicago.org/Buildings/Building-Permits/ydr8-5enu, filtered only for New Construction permits

- https://www2.illinois.gov/rev/localgovernments/property/Documents/cpihistory.pdf

- https://www.bls.gov/news.release/cpi.t01.htm

- https://www.bls.gov/opub/ted/2020/consumer-prices-for-food-at-home-increased-4-point-8-percent-for-year-ended-may-2020.htm

- https://www.cookcountyassessor.com/news/changes-assessments-and-appeals-due-covid-19

- https://prodassets.cookcountyassessor.com/s3fs-public/reports/COVID19/COVIDAdjustmentsSouthTriPropertyValues.pdf

- https://www.cookcountyassessor.com/cook-county-assessors-office-values

- City Ordinances O2020-894, O2020-896, O2020-901, O2020-902, O2020-903, O2020-904, O2020-907

- https://www.ilga.gov/legislation/publicacts/fulltext.asp?Name=101-0647

- Specifically, CPS’ proportionate share of Transit TIF revenue is equal to its tax rate divided by the total composite tax rate faced by taxpayers. In 2018, CPS’ tax rate is 3.552 percent, 52.3 percent of the composite tax rate of 6.786 percent. Currently, this is the only TIF district which produces dedicated revenues for CPS, rather than being subject to the TIF surplus mechanism common to all other districts.

- https://www.cookcountyclerk.com/sites/default/files/pdfs/2018%20TIF%20Report.pdf, page 18

- https://budget.illinois.gov/content/dam/soi/en/web/budget/documents/budget-book/fy2021-budget-book/fiscal-year-2021-operating-budget-book.pdf, page 145

- https://www.chalkbeat.org/2020/5/26/21271188/ohio-new-york-schools-budget-cuts

- Prior to July 1, 2020, these schools were governed and authorized by the Illinois State Charter School Commission (SCSC). These powers were transferred to ISBE by Public Act 101-0543.