Chicago Public Schools (CPS) does not receive revenues when it pays expenses. As a result, CPS’ cash flow goes through peaks and valleys throughout the year, depending on when revenues and expenditures are received and paid. Further, revenues are generally received later in the fiscal year while expenditures, mostly payroll, are level across the fiscal year—with the exception of debt service and pensions. The timing of these two large payments (debt service and pensions) occur just before major revenue receipts. These trends in revenues and expenditures put cash flow pressure on the district.

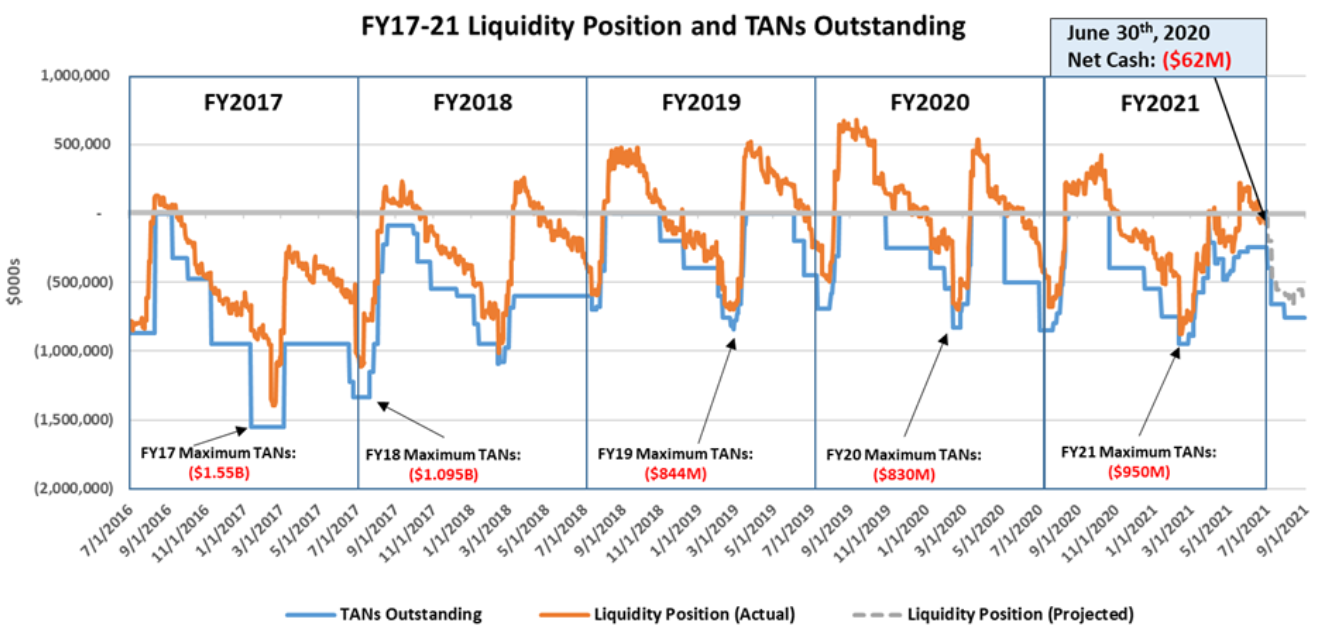

Over the past four years, CPS has reduced its short-term borrowing by approximately $600 million. Despite the unprecedented circumstances related to COVID-19, the district continued to make progress on improving its cash flow by decreasing the Tax Anticipation Notes (TANs) outstanding at the end of the year by $256 million, increasing the net cash position on June 30 by approximately $172 million, and saving approximately $6 million in short-term interest costs. CPS spent approximately two months of the year without short-term borrowing.

In FY2021, approximately $3.7 billion, or 60 percent of CPS’ current year revenues excluding non-cash items, were received after February, more than halfway into the fiscal year. The annual debt service payment is made in mid-February, just prior to the receipt of approximately $1.4 billion of the first installment of property tax revenues. The annual Chicago Teachers’ Pension Fund (CTPF) pension payment is made in late June, just before CPS receives approximately $1.3 billion of the second installment of property taxes.

Historically, approximately 50 percent of the Chicago Board of Education’s budgeted expenditures are for payroll and associated taxes, withholding, and employee contributions. In addition, the Board’s recurring expenses for educational materials, charter school payments, health care, transportation, facilities, and commodities total approximately 40 percent of the Board’s budgeted expenditures. The timing of these payments is relatively predictable and spread throughout the fiscal year. Approximately 10 percent of budgeted revenues, which flow through the operating account, comprise debt service, annual pension payments, and interest on short-term debt.

Most organizations set aside reserves in order to weather these peaks and valleys in cash flow. In FY2021, the Board updated its fund balance policy to align itself with the Government Finance Officers Association (GFOA) which recommends reserve levels between five and fifteen percent of spending. As of June 30, 2021, the district projected that the general fund balance totaled $566 million and that CPS has approximately $183 million of cash, with $244 million in short-term borrowing outstanding.

Revenues

CPS has three main sources of operating revenues: local, state, and federal.

- Local Revenues: Local revenues are largely made up of property taxes. In FY2021, CPS will receive approximately $3.27 billion of property taxes, of which $2.7 billion was issued to the Board’s operating fund, $490 million was distributed to the CTPF through the pension levy, and $61 million is allocated to capital projects through the Capital Improvement Tax levy. The Board receives property tax revenues in two installments, 96 percent of which are received from February onwards, over halfway through the fiscal year. The first installment of approximately $1.4 billion is due March 1 and is received into the main operating account in late February or March. In FY2021, while the first installment due date remained March 1, the tax penalty tax was moved to May 3. This resulted in a delay of a portion of those property taxes typically received in March. The second installment of approximately $1.3 billion is anticipated to be received past July or August, depending on the deadline. In FY2020, the second installment tax penalty date was moved to October 1, 2021 due to COVID-19, which has caused some property tax receipts to be delayed by approximately 60 days. Property tax receipts have grown from $2,352 million in FY2012 to a projected $3,374 million in FY2022—a compounded growth rate of 3.3 percent.

- State Revenues: State revenues largely comprise Evidence-Based Funding (EBF) and state grants. EBF is received regularly from August through June in bi-monthly installments. In FY2021, EBF totaled approximately 71 percent of the state revenues received by CPS, up from 57 percent in FY2017 before EBF was created. This increase improves cash flow due to the consistency of the payments. Block grant payments are distributed sporadically, and approximately $23 million of block grants were vouchered but not disbursed to CPS as of June 30, 2021.

- Federal Revenues: The state administers categorical grants on behalf of the federal government once grants are approved. In three of the last four fiscal years, federal revenues were not received until about halfway into the fiscal year. In FY2021, only approximately $104 million of the $1.3 billion of budgeted federal revenues were received before January 2021. As of June 2021, CPS has received approximately $417 million in CARES and ESSER II revenues in FY2021. Approximately $304 million of this revenue was received in May 2021—one month before the end of the fiscal year.

- Working Capital Short-Term Borrowing: The district has the ability to issue short-term borrowing in order to address liquidity issues. Short-term borrowing allows the Board to borrow money to pay for expenditures when cash isn’t available, and then repay the borrowing when revenues become available. State statute provides CPS with the ability to issue this type of cash flow borrowing through TANs. In FY2021, CPS issued a maximum of $950 million in TANs to support liquidity. As of June 30, 2021, CPS had approximately $244 million of TANs outstanding compared to $500 million outstanding in FY2020, a decrease of $256 million. These TANs are repaid from the district’s operating property tax levy. To support liquidity in FY2022, CPS is prepared to issue TANs against the second installment property taxes as the need arises. This will allow the Board to maintain liquidity despite the uncertainty of the timing of the property tax revenues between July through October. Short-term borrowing requires that CPS pays interest on these bonds. In FY2022, the Board budgeted approximately $12 million in interest costs for the TANs.

Expenditures

CPS expenditures are largely predictable, and the timing of these expenditures can be broken down into three categories: payroll and vendor, debt service, and pensions.

- Payroll and Vendor: Historically, approximately $3.3 billion of CPS’ expenditures are payroll and associated taxes, withholding, and employee contributions. These payments occur every other week, and most of the expenditures are paid from September through July. Approximately $2.4 billion of CPS vendor expenses are also relatively stable across the year.

- Debt: Long-Term debt service is deposited into debt service funds managed by independent bond trustees. These debt service deposits are backed by EBF and are deposited once a year. In FY2021, the debt service deposit from EBF was approximately $445 million in mid-February. The timing of this debt service deposit comes just before CPS received approximately $1.4 billion in property tax revenues. The remainder of the bonds are paid by personal property replacement taxes and/or property taxes that are deposited directly with the trustee, meaning they do not pass through the district’s operating fund from a cash perspective. The timing and amount of these payments are dictated by the bond documents. Once the trustees have verified that the debt service deposit is sufficient, they provide a certificate to the Board which allows the Board to abate the backup property tax levy that supports the bonds.

- Pensions: In FY2021, approximately $65 million of the pension payment was made on June 30, 2021, while approximately $14 million of the pension payment was made previously during FY2021. The timing of the bulk of the pension payment comes just before CPS receives approximately $1.3 billion in property tax revenues. In FY2022, a dedicated pension levy will directly intercept $458 million in revenue to the CTPF—these revenues do not pass through the district’s operating funds from a cash perspective. The dedicated pension levy plus the state funding for pensions means that approximately 87 percent of CPS’ pension obligation is currently funded by structural funding sources. The Board will contribute $100 million in the fall 2021 to the Municipal Employees’ Annuity and Benefit Fund (MEABF) due to the City no longer picking up the full employer pension costs for CPS.

Forecasted Liquidity

The chart below provides CPS’ liquidity profile from FY2017 to FY2021. As shown in the chart below, the district spent approximately four months in a net positive cash flow position in FY2021.

Chart 1: FY2017–FY2021 Operating Liquidity Position