As recently as 2017, pension costs represented CPS’ greatest budgetary risk, as growing pension payments, shouldered almost entirely by Chicago taxpayers, diverted more funding each year from classrooms. Education funding reform passed that fall by the state of Illinois represented a significant step toward correcting the historical inequity that––unlike every other district in the state––burdened Chicago with the entirety of its teacher pension obligations. The structural pension funding changes included in the state’s education funding reform set in motion progress that reduced the district’s diversion of funds eligible to support classrooms from $676 million in FY2016 to $203.5 million in the FY2022 budget.

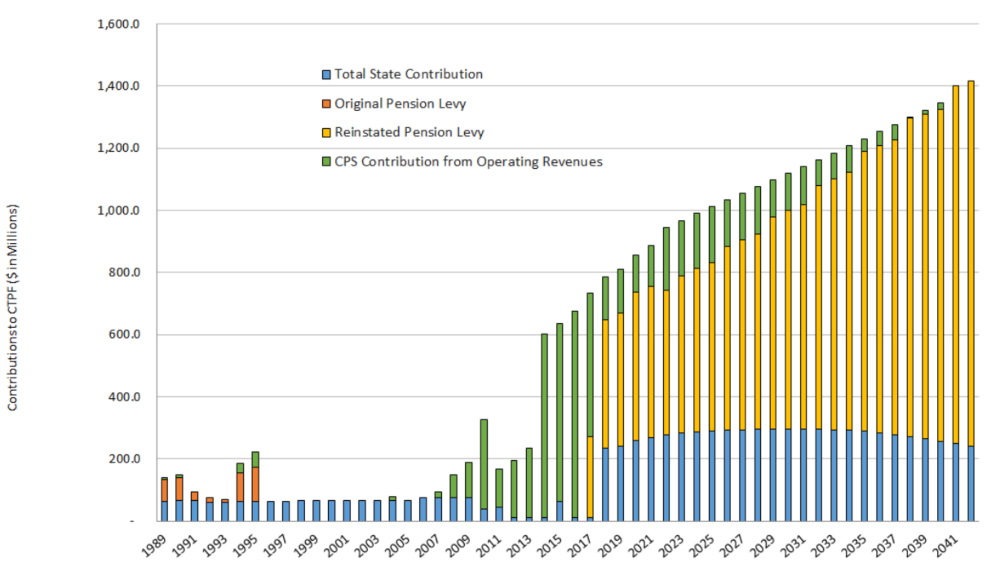

Two major changes at the state level are responsible for this progress, which greatly reduced the budgetary risk of the district’s pension obligations and put CPS on a path to pension funding stability. The first change involved the state providing funding for the district’s normal cost––the cost of annual increases to the district’s total liability––for teacher pensions. In FY2022, the state will provide $265 million for these costs. The second change was the state’s reinstitution into the property tax code, which gives the district the ability to levy a dedicated property tax to assist with the annual pension payments. Though this cost is covered by Chicago taxpayers, it will provide dedicated funding for teacher pensions in the amount of $463.8 million in FY2022, continuing the district’s improved ability to fund its pension liabilities.

FY2022 marks the third year that CPS will pay the City of Chicago annually for the city’s coverage of CPS employees participation in the Municipal Employees’ Annuity and Benefit Fund (MEABF) of Chicago. Before FY2020, the City assumed the entirety of the payment made on behalf of CPS non-teaching employees covered by the MEABF. CPS reimbursed the City $60 million in the first two years, but will contribute $100 million to the City in FY2022.

CPS remains the only school district in the state with its own teachers’ pension system, which is separate from the statewide Teachers’ Retirement System (TRS). CPS full-time salaried teachers and other licensed teaching staff are part of the Chicago Teachers’ Pension Fund (CTPF), which historically has been funded entirely by Chicago taxpayers with little support, until recently, from the state. Under this arrangement, Chicago taxpayers have faced the unique burden of having to support both the CTPF and the TRS. Like all other working Illinoisans, their income, corporate, and sales taxes paid to the state fund TRS costs, but Chicagoans alone support the CTPF through property taxes and other local revenue streams.

As part of education funding reform, the state has taken steps to address this long-standing inequity. Beginning in FY2018, the state has contributed funding in the amount of CPS teacher pension normal costs (i.e. the cost of the benefits that are projected to be created in the current year). In addition, the state reinstated a CPS teacher pension property tax levy in FY2017 that is appropriated exclusively for paying CTPF costs. A 0.567 percent maximum levy on the adjusted Equalized Assessed Value (EAV)1 of Chicago properties goes towards covering CPS’ statutory obligations to the CTPF.

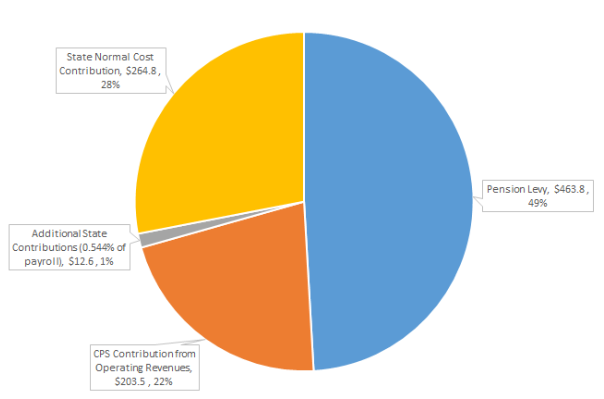

In FY2022, per the CTPF’s 2020 actuarial report2, the total required employer contribution to the CTPF will be $944,677,000. Of that number, the state will pay $277.4 million (comprising the projected normal cost and 0.544% of the CTPF’s total payroll, pursuant to Public Act 90-0655) and the reinstated pension property tax levy is projected to raise $463.8 million. Other operating revenues will contribute toward the remaining $203.5 million, as shown in Chart 1.

Chart 1: Projected FY2021 Funding for Required CTPF Employer Contributions

Compared to FY2021, the district will divert an additional $72.1 million from operating funds to cover the increase in pension costs. This increase is due to a COVID-related downward reassessment of property values as well as a change in the expected return on investment of pension fund assets. More details on the breakdown of FY2022 employer costs can be found in the footnoted CTPF actuarial report.

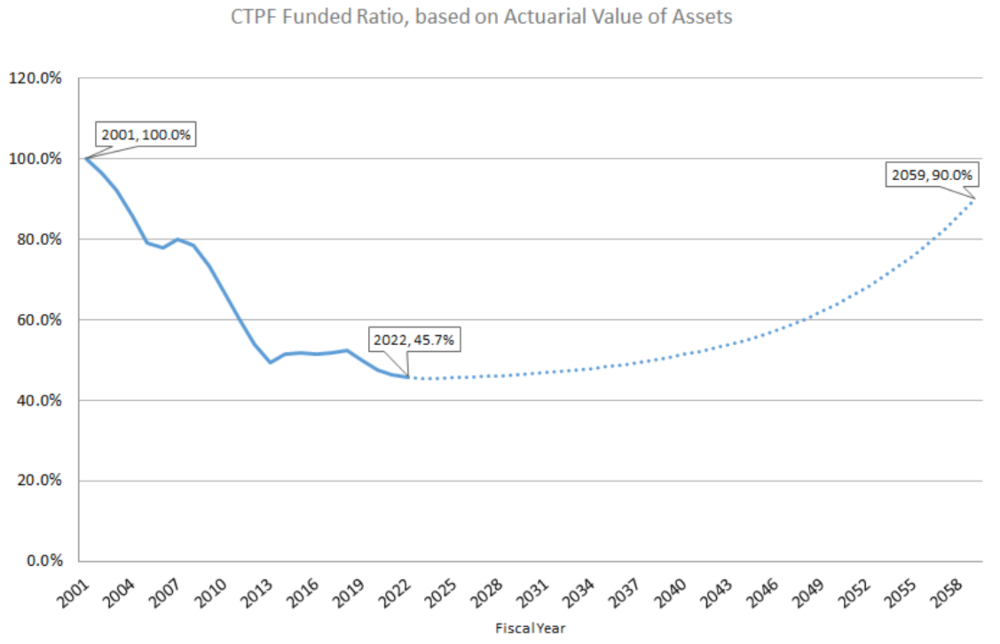

The funded ratio of the CTPF based on the actuarial value of assets declined to 46.69 percent as of June 30, 2020, down from 47.40 percent on June 30, 2019. This decline is primarily due to changes to the actuarial assumptions used in the fund’s valuation. Most notably, the fund decreased the investment return assumption from 7 percent to 6.75 percent. The unfunded actuarial accrued liability (UAAL) grew by $603 million to $12.8 billion.

There Remains a Large Disparity in how the TRS and CTPF are Funded by the State

The passage of state education funding reform in 2017 began to address a pension system that unfairly penalized Chicagoans.

Even though both the CTPF and TRS are governed by state statute, there has been a vast difference in the source of funding for both pension systems. The state of Illinois is projected to pay $277.4 million in FY2022 for CTPF teacher pension costs, which represents 29 percent of the total employer contribution. On the other hand, the state is projected to contribute $5.69 billion toward the employer contribution to the TRS, which is nearly 99 percent of the total employer contribution.3

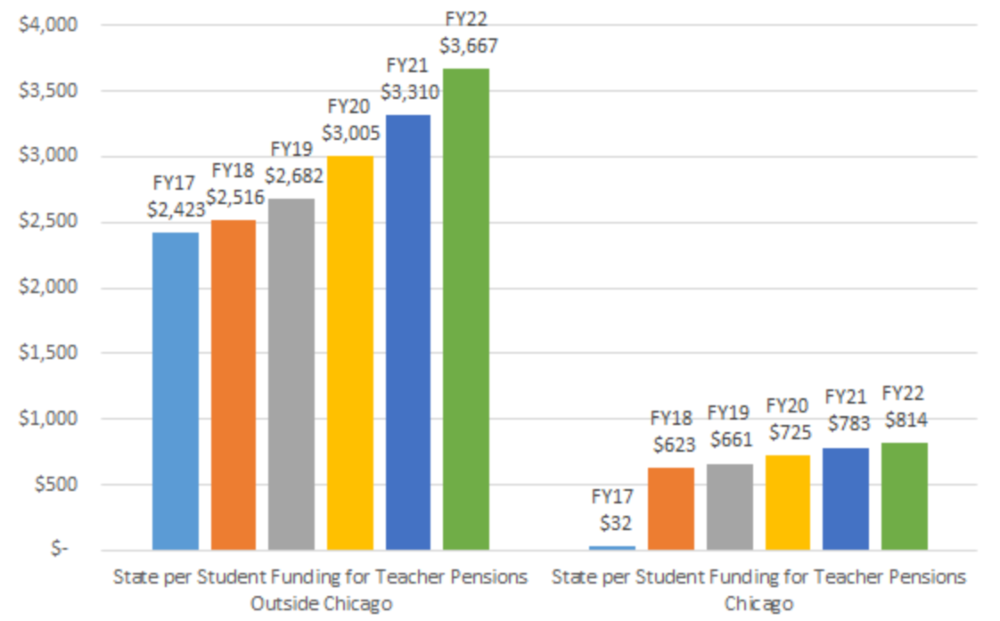

In FY2022, the state’s estimated contribution to TRS amounts to a pension contribution for downstate and suburban school districts of $3,667 per student, while CPS only received $814 per student (Chart 2). Before the state began to pick up the normal cost in FY2018, the disparity between Chicago and all other school districts in Illinois was significantly larger.

Chart 2: State Per-Pupil Contribution Disparity for Teacher Pension Funds

Impact of COVID-19

COVID-19 will likely increase the amount of money that CPS has to divert from other operating costs due to a decline in overall assessed value in Chicago. The pension levy is a flat 0.567 percent of all assessed value within the city, which means that any decline in assessed value will decrease the total revenue that flows to CPS. This is a revenue source that is responsive to property values, in contrast to the education property tax levy, which is capped to the rate of inflation. In the spring of 2020, the Cook County Assessor’s Office (CCAO) announced that all properties within the city would have “their property values [for Tax Year 2020] reviewed for estimated effects of COVID-19 following the appeal process."4 The impact of any across-the-board adjustments to property values will only be reflected in property tax revenues collected in FY2022. For more information, see the revenue chapter in this book.

CPS’ Pension Contribution Requirements as an Employer

In FY2022, CPS is projected to contribute $667.3 million for Chicago pensions out of its own resources ($463.8 million of which comes from the property tax pension levy), with the state picking up the other $277.4 million. Of the $277.4 million in state funding, $264.8 million is for CTPF normal cost, and $12.6 million is for “additional” state contributions. These “additional” state contributions are statutorily required to offset the portion of the cost of benefit increases enacted under Public Act 90-0582 and are calculated as 0.544 percent of the Fund’s total teacher payroll.

Revenues from the pension levy make up the majority of CPS’ contribution to the CTPF, estimated at $463.8 million in FY2022. The pension levy was reinstated in FY2017 as part of pension reform at an initial flat rate of 0.383 percent of Equalized Assessed Value (EAV), which increased to the current 0.567 percent rate in FY2018.

Chicago property values are projected to experience continued growth in the long-term after the fiscal effects of COVID-19 have abated, and as such the pension levy will generate more revenue in future fiscal years. This will decrease diversions from operating revenues that could otherwise be spent directly on investments in Chicago’s children. However, In FY2022, diversions from operating revenues are projected to grow from an anticipated $131.4 million to $203.5 million.

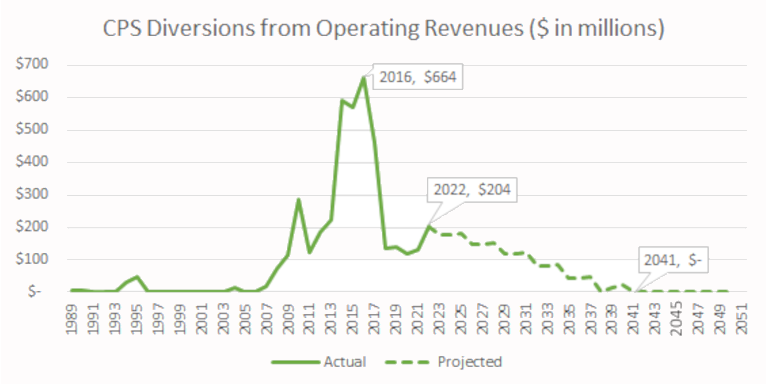

Based on the CTPF’s 2020 actuarial report, and an assumption of approximately 8 percent growth in property values in assessment years and 2 percent growth in non-assessment years, CPS is on track to have no diversions from other operating revenues by FY2041. Although this represents an improvement from recent years, during which diversions from operating revenues peaked at $664 million in FY2016, the costs associated with paying for CTPF contributions will continue to be significant for the foreseeable future.

Chart 3: Diversions from Operating Revenues are Projected to Continue until 2041

Pension Contributions by the State and by Individual Employees

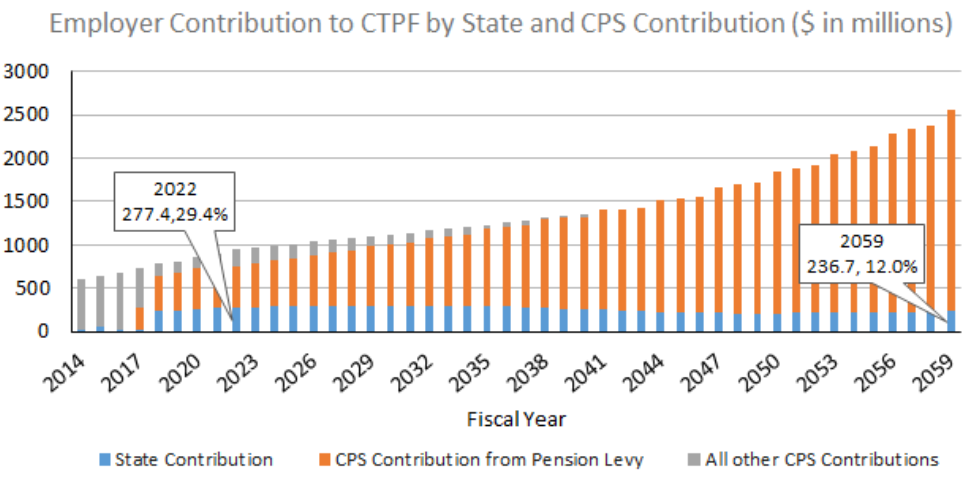

As the total employer contribution costs continue to increase in accordance with the actuarially required amount to reach a 90 percent funding ratio of CTPF by 2059, state contributions will shrink as a total share of the overall revenues used to cover this cost, if limited to just the normal cost and the “additional” 0.544 percent of payroll. In FY2022, the state’s contribution is projected to make up 29.4 percent of the total employer contribution, and this is scheduled to decline to 12 percent by 2059 if there is no further expansion of the CTPF’s employer cost assumed by the state. The normal cost borne by the state will gradually decline as a greater share of the workforce covered by CTPF comprises “Tier II” teachers who are entitled to a lower level of benefits. CPS is reliant on the state continuing to add funding to the Evidence Based Funding (EBF) model so that future pension costs do not prohibit us from investing in students and schools.

Chart 4: The State Share of CTPF Costs will Shrink in Future Years

At the individual level, employees covered by CTPF are required by statute to contribute 9 percent of their salary to pensions. However, from 1981 through 2017, CPS paid the first 7 percent on the employee’s behalf in addition to its own employer contribution. Under the 2020-24 Collective Bargaining Agreement with the Chicago Teachers Union, CPS no longer pays 7 percent for “Tier II” employees hired on or after January 1, 2017.

Decline in Funded Ratio Led to Increased CPS Contributions

Until June 30, 2001, CTPF had a funded ratio of 100 percent, and according to state law, CPS did not have to make an employer contribution. By June 30, 2004, the funded ratio had dropped to 86 percent, below a 90 percent threshold, and therefore CPS was statutorily required to make employer contributions beginning in 2006.

Chart 5: CTPF Funded Ratio Has Generally Decreased Since Early 2000s (Actuarial Value of Assets)

For the latest CTPF valuation, the rate of return assumption was lowered from 7 percent to 6.75 percent, lowering the expected future value of fund assets and decreasing the funded ratio. As such, the certified CPS employer contributions for FY2022 is $667.3 million, $30.3 million higher than the prior year’s FY2022 projection of $637 million, reflecting an increase in the actuarial accrued liability of the CTPF by $821 million.

CPS’ Pension Contributions Continue to Grow

Pension contribution costs borne by CPS will continue to grow until 2059, with the majority covered by the pension levy. The state’s assumption of the normal cost since FY2017 will not fully fund the rising total costs of pension contributions because the normal cost is projected to decline as a share of the total employer cost. The pension levy, if assumed to stay flat at 0.567 percent of a property’s value, should eventually pay for CPS’ entire share of the pension costs. However, long-term fiscal stability is still predicated upon the state lessening the tax burden placed on Chicagoans by fully funding the EBF model, which will provide additional resources to CPS and other school districts that primarily educate low-income students. More discussion on the state’s EBF formula can be found in the Revenue chapter of the Budget Book.

Chart 6: CPS Employer Pension Contributions Will Continue to Grow Every Year, With the Majority Covered by the Reinstated Pension Levy

MEABF Contributions

FY2020 was the first year that CPS covered some of the costs associated with its non-teaching employees covered by the Municipal Employees’ Annuity and Benefit Fund (MEABF). Prior to FY2020, the City of Chicago covered the entire cost of the MEABF employer contribution. As part of an Inter-Governmental Agreement (IGA) with the City of Chicago, the Board of Education will pay $100 million to the city in FY2022, to fund a portion of the city’s obligation to the MEABF.

- Per 105 ILCS 5/34-53 and 35 ILCS 200/18-45, CPS has the ability to tax up to a 0.567 percent levy on the prior year’s taxable non-TIF base property, and the current year’s taxable non-TIF new property.

- https://www.ctpf.org/sites/files/2020-12/Final%20FY%202020%20State%20of%20Illinois%20Required%20Certification.pdf

- https://www.trsil.org/sites/default/files/documents/Final-Actuarial-Valuation-2020.pdf, page 39

- https://www.cookcountyassessor.com/news/changes-assessments-and-appeals-due-covid-19