The FY2024 Budget will include a historic high of $1,022.5 million for the Chicago Teachers’ Pension Fund (CTPF). With a strong investment market in FY2022 and increased pension levy revenues, CPS did not need to spend any of its operating revenue on CTPF contributions for FY2023 — the first time in the last twenty years where CTPF was wholly funded by dedicated state and local revenue sources. However, weak investment returns and higher-than-assumed salary increases in FY2023 will require that CPS once again contribute operating revenues in FY2024 to satisfy its statutory contribution obligations.

The structural changes enacted in FY2017 and FY2018 that altered the funding mechanisms supporting the CTPF provided several key measures to ensure long-term pension health. In FY2017, the Illinois General Assembly granted CPS the ability to implement a property tax levy dedicated to funding the CTPF at a tax rate of 0.383 percent of the Equalized Assessed Value (EAV) of Chicago properties. That rate was then raised in FY2018 to a maximum rate of 0.567 percent. Additionally in FY2018, the State of Illinois (the State) made a commitment to pay the employer’s normal cost for pension obligations, which is the amount of future pension benefits that CTPF-eligible employees will accrue over a given fiscal year. In FY2024, this normal cost comes out to 30.1 percent of the total employer contribution amount. Despite these improvements, however, CPS still bears legacy costs that have — aside from FY2023 — required the use of operating revenue to cover the difference between the levy’s revenue and CPS’ statutory pension payment. Nonetheless, CPS continues to make all statutory contributions to the CTPF in accordance with the pension ramp, which has the mandate that CTPF be 90 percent funded by FY2059.

These costs are a burden unique to CPS. CPS remains the only school district in the State of Illinois with its own teachers’ pension system separate from the statewide Teachers’ Retirement System (TRS). Full-time salaried CPS teachers and other licensed teaching staff are part of the CTPF, which, until recently, has been funded almost entirely by Chicago taxpayers with little support from the State. Under this arrangement, Chicago taxpayers have faced the unique burden of having to support both the CTPF and the TRS. Like all other working Illinoisans, portions of their income, corporate, and sales taxes paid to the State go toward funding TRS costs, but Chicagoans alone are responsible for supporting the CTPF through property taxes and other local revenue streams.

Per the CTPF’s 2022 actuarial report, the total statutory, or required, employer contribution to the CTPF for FY2024 will be $1,022.5 million. Of that number, the State will pay $322.7 million, which is comprised of the projected normal cost of $308.1 million and $14.6 million to offset the benefit increases enacted under Public Act 90-0582 (this is set at 0.544 percent of the CTPF’s total payroll pursuant to Public Act 90-0655). This total of $322.7 million also includes $65 million in the form of a health insurance subsidy for retirees. The pension property tax levy is projected to raise $557.1 million in FY2024, up $5.5 million from FY2023. This means that the Chicago Board of Education will be responsible for funding the remaining $142.7 million differential to meet the total required contribution for CPS of $699.8 million.

While the pension property tax levy increased in gross revenue from FY2023 to FY2024, the bump in revenue was not enough to offset the spike in required contributions resulting from a sluggish investment market. In the FY2021 actuarial report for the CTPF, the total required employer contributions was estimated to be $880.1 million for FY2024. The impact of the 2022 investment market was so intense that in the FY2022 actuarial report, the total required employer contribution was upped to $1,022.5 million, an increase of $142.4 million or 16 percent above the original estimate. This unplanned increase in cost affects CPS, rather than the State, since the State’s contributions remain constant while CPS is required to absorb the statutorily determined growth within its own resources.

Chart 1: Projected FY2024 Funding for Required CTPF Employer Contributions ($ in Millions)

Depressed Investment Returns Created Unexpected Growth for FY24 CPS Contributions

The funded ratio of the CTPF based on the actuarial value of assets (AVA) decreased to 46.8 percent as of June 30, 2022, down from 47.5 percent on June 30, 2021. This actuarial value is determined by a four-year smoothing method that helps account for unexpected gains or losses and provides better baselines for long-term fiscal planning. Therefore, it is much more stable year-to-year than the market value of assets (MVA) detailed below. Despite this one-year drop, the AVA funded ratio for the plan is up 0.1 percent from June 30, 2020.The decrease in the funded ratio stems from a lower-than-expected return on the actuarial value of assets in FY2022, which came in at 6.0 percent instead of the assumed rate of 6.5 percent. When using the MVA to estimate, which examines the unadjusted returns within a fiscal year, we see that the funded ratio dropped from 53.2 percent in FY2021 to 45.3 percent– a -8.6 percent change. It is important to note that this is a result of overarching market volatility and is not isolated to CPS. In fact, most large pension plans experienced losses during FY2022. It was this drop that drove the reassessment of mandatory contributions explained on the prior page: $142.4 million more than expected. This swing in asset value mandates these larger contributions to cover for the losses experienced during the prior fiscal year.

The unfunded actuarial accrued liability for CTPF (UAAL) grew by $620.4 million to $13.812 billion, driven primarily by unexpected investment losses due to market forces and larger-than-assumed salary increases over FY2022, which are tied to collective bargaining agreements and negotiated salary increases. The UAAL is calculated by taking the total accumulated cost of pension benefits and subtracting the value of the total assets in the plan’s possession.

The State Continues to Fund CTPF at a Lower Rate than the TRS

The passage of state education funding reform in 2017 began to address a pension system that unfairly penalized Chicagoans. Even though both the CTPF and TRS are governed by state statute, there has been a vast difference in the source of funding for both pension systems. The State of Illinois is projected to pay $322.7 million in FY2024 for CTPF teacher pension costs, which represents 32 percent of the total employer contribution. In comparison, the State is projected to contribute $6.04 billion toward the employer contribution to the TRS in FY2024, the vast majority of the employer contribution for this fiscal year. In FY2021 and FY2022, the State’s contribution to the TRS made up about 98 percent of the total employer compensation, leaving local districts responsible for covering just 2 percent of the employer contribution to the system.

To demonstrate this discrepancy, in FY2022, the State contributed an average of $48.49 to the TRS for every $1 that local school districts contributed to the TRS. For FY2022, the State gave just $0.42 for every $1 that the Chicago Board of Education contributed to the CTPF. In FY2024, the State will provide around $0.46 for every $1 that the Chicago Board of Education will contribute.

Another way to think about this difference is to examine the average contribution from the State to the two retirement funds on a per pupil basis. In FY2024, the State’s estimated contribution to TRS amounts to a pension contribution for downstate and suburban school districts of $3,933 per student, while CPS only received $997 per student.

Chart 2: Average Contribution per Pupil by the State to the TRS and CTPF in FY2024

CPS’ Employer Contribution Requirements: Diverting Operating Funds to Bridge the Gap

In FY2024, CPS is projected to contribute $699.8 million for Chicago teachers’ pensions, with $142.7 million of its own operating revenue and $557.1 million from the dedicated pension levy. The State will pick up the other $322.7 million, of which $308.1 million is for CTPF normal costs, and $14.6 million is for “additional” state contributions. These “additional” state contributions are statutorily required to offset the portion of the cost of benefit increases enacted under Public Act 90-0582 and are calculated as 0.544 percent of CTPF’s total teacher payroll.

In FY2023, $551.6 million of pension levy revenues made up the entirety of CPS’ contribution to the CTPF. In FY2024, CPS will contribute $557.1 million in levy revenue to the CTPF, but that alone will not be enough to meet the statutory obligation. While Chicago property values are projected to experience continued growth in the long-term, bringing with it increased opportunity for additional revenue, the rate of increase for the levy revenues in FY2024 was not able to keep up with the need for additional funds to compensate for investment losses incurred over the prior year.

While the levy’s revenue increased 0.1 percent from FY2023 to FY2024, the projected CPS required contribution for FY2024 increased 23.3 percent over the same year-long time period. Therefore, in FY2024, CPS must once again divert $142.7 million in additional operating revenue to help complete the statutory contributions. Based on estimations of pension levy growth due to an increased EAV, CPS will continue to rely on operating revenue to bridge the gap of statutory contributions until approximately FY2047.

Chart 3: Diversions from Operating Revenues are Projected to Continue until 2047 Without Increased State Funding

Pension Contributions by the State and Individual Employees

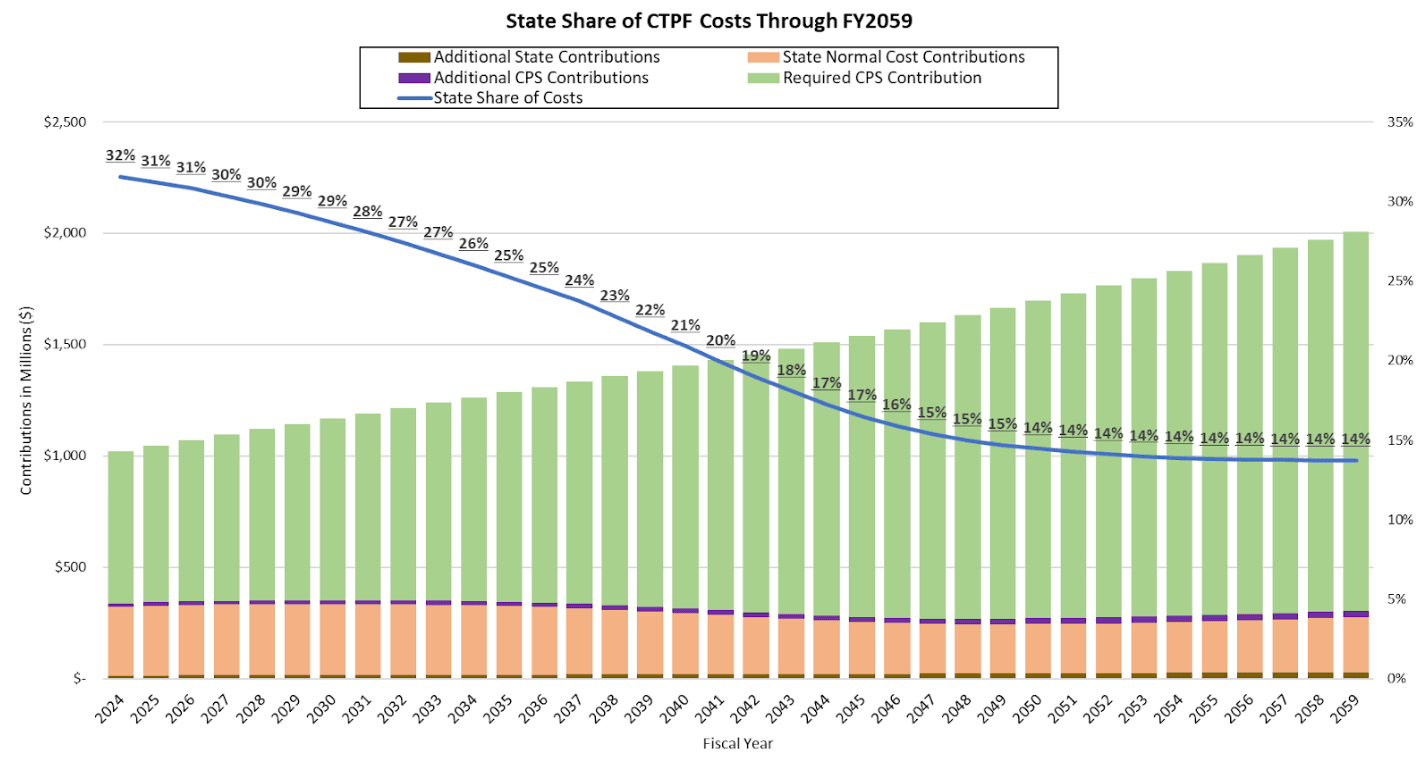

As the total employer contribution costs continue to increase in accordance with the actuarially required amount to reach a 90 percent funded ratio of CTPF by 2059, state contributions will shrink as a total share of the overall revenues used to cover this cost, if limited to just the normal cost and the “additional” 0.544 percent of payroll pursuant to Public Act 90-0655 to cover increased cost of benefit increases enacted under Public Act 90-0582.

In FY2024, the State’s contribution is projected to make up 32 percent of the total employer contribution, and this is scheduled to decline to 14 percent by 2059 if there is no further expansion of the CTPF’s employer cost assumed by the State. The normal cost borne by the State will gradually decline as a greater share of the workforce becomes “Tier II” teachers who are entitled to a less generous level of benefits than “Tier I” employees. CPS is reliant on the State continuing to add funding to the Evidence-Based Funding (EBF) model so that future pension costs do not prohibit us from investing in students and schools. More discussion on the State’s EBF formula can be found in the Revenue chapter of the Budget Book.

Chart 4: The State Share of CTPF Contributions will Shrink in Future Years ($ in Millions)

At the individual level, employees covered by CTPF are required by statute to contribute 9 percent of their salary to pensions. However, from 1981 through 2017, CPS paid the first 7 percent on the employee’s behalf, in addition to its own employer contribution. Under the 2019–24 Collective Bargaining Agreement with the Chicago Teachers Union, CPS no longer pays the initial 7 percent for “Tier II” employees hired on or after January 1, 2017, leaving them to contribute the entirety of that 9 percent.

Decline in Funded Ratio Led to Increased CPS Contributions

Until June 30, 2001, CTPF had a funded ratio of 100 percent, and according to state law, CPS did not have to make an employer contribution. By June 30, 2004, the funded ratio had dropped to 86 percent, below a 90 percent threshold, and therefore CPS was statutorily required to begin making employer contributions. State funds would not begin to ramp up in earnest, however, until the passing of Public Act 99-521, which took effect in 2017. As seen in the graph below, despite the investment losses seen in FY2023, the District is on course to meet the FY2059 deadline of being 90 percent funded. A full explanation of the designated baseline ramp can be found in the FY2022 Actuarial Valuation Report.

Chart 5: CTPF Funded Ratio Through FY2059 (Actuarial Value of Assets and Market Value of Assets)

MEABF Contributions

Employees of CPS that do not participate in the CTPF participate in the Municipal Employees’ Annuity and Benefit Fund (MEABF). The MEABF is a City of Chicago pension annuity fund established to fund retirement for most civil servant employees of the City of Chicago. Non-teacher employees of CPS are also allowed to be part of the fund.

From FY2020 to FY2023, CPS reimbursed the City for a portion of the City's cost attributable to District employees that participate in the fund. In FY2024, CPS anticipates paying the city a portion of the on-behalf-of cost. The exact amount of CPS’s contribution for the FY2024 portion to MEABF will be funded by TIF revenue above and beyond the FY2024 approved and other appropriate local resources.