Teachers and other employees have worked hard for their pensions, and the district’s priority is to protect employee benefits while preserving investments in schools to continue the academic progress our students have made.

For many years, pensions have been the single largest driver of the district’s structural deficit, as CPS teachers are part of the Chicago Teachers’ Pension Fund (CTPF), which historically has been funded entirely by Chicago taxpayers with little support — until recently — from the state. At the same time, Chicago taxpayers also help support the Teachers’ Retirement System (TRS), which is the pension fund for teachers outside of CPS. This has meant that Chicago taxpayers supported their own teachers’ pension fund, as well as and paid into the state teachers fund.

As part of education funding reform, the state has begun to address this long standing inequity. In the near-term, the state has begun paying for the normal cost of CPS teacher pensions, and in the long-term this will deliver full pension equity for CPS. To address the remaining near-term costs borne by CPS, the state reinstated a CPS teacher pension property tax levy in FY2017, which dedicates additional Chicago property tax dollars to the Chicago Teacher Pension Fund.

CPS Teacher Pension Burden Remains Large, But Has Improved in Recent Years

The passage of state education funding reform has begun to address a pension system that for many years placed CPS in a uniquely difficult financial situation.

Even though both CPTF and TRS are governed by state statute, there has been a vast difference in how pensions are funded. The state picking up CPS teacher pension normal cost relieves CPS of approximately 28% of its annual teacher pension contribution, while nearly 100% of teacher pensions outside of Chicago are paid for by the state.

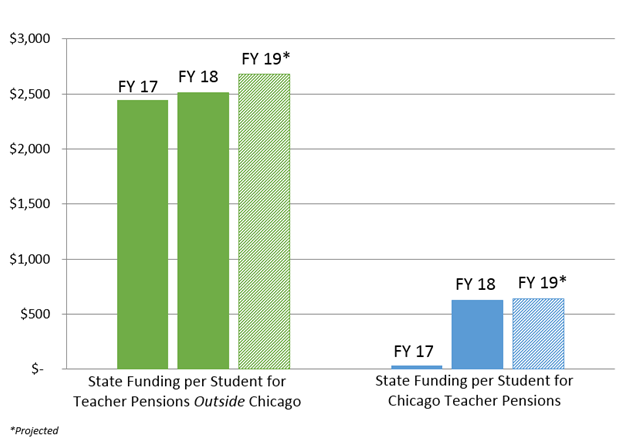

In FY2018, the state made a $4.1 billion contribution to TRS. This amounts to a pension contribution for downstate and suburban school districts of $2,512 per student, while CPS received $623 per student (Chart 1). Those amounts are expected to grow to $2,683 and $639, respectively, in FY2019.

Chart 1: State Per-Pupil Contribution Disparity for Teacher Pension Funds

CPS’ Pension Contribution Requirements

Teachers and other employees with teaching certificates (e.g., principals) who work at CPS participate in the CTPF.

CPS is required to make an annual contribution to CTPF, based on an actuarial calculation sufficient to bring to 90 percent the “funded ratio” of actuarial assets to liabilities by 2059. By statute, CPS is also allowed to offset its contribution by the amount of any state funding contributed to the pension fund.

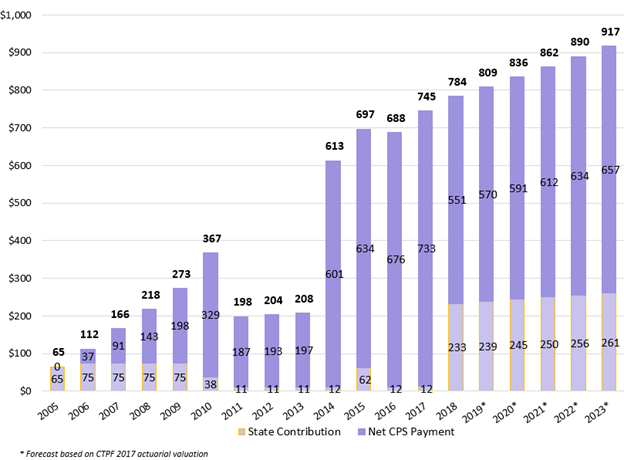

In FY2018, CPS contributed $551 million for Chicago pensions out of its own resources, with the state picking up the other $233 million. Of the $233 million in state funding, $221 million is for CTPF normal cost and $12 million is for “additional” state contributions. These “additional” State contributions are statutorily-required to offset the portion of the cost of benefit increases enacted under Public Act 90-0582, and are calculated as 0.544% of the Fund’s total teacher payroll.

The $551 million contribution represents a 25% reduction over CPS’ required FY2017 contribution of $733 million. In FY2019, CPS is required to pay $570 million of the total $809 million employer contribution, with the state paying the other $239 million.

Chart 2: CPS’ Required Employer Contributions to CTPF Grows Dramatically; EBF Formula Needs Annual Funding Increases to Close Remaining Pension Equity Gap ($ in millions)

At the individual level, employees covered by CTPF also are required by statute to contribute 9 percent of their salary to pensions (“employee contribution”). However, from 1981 through 2017, CPS paid 7 of the 9 percent for a total of $127 million budgeted in FY2017 for participants in CTPF, in addition to its own employer contribution. Under the 2015-19 Collective Bargaining Agreement with the Chicago Teachers’ Union, CPS no longer pays 7 percent for employees hired on or after January 1, 2017.

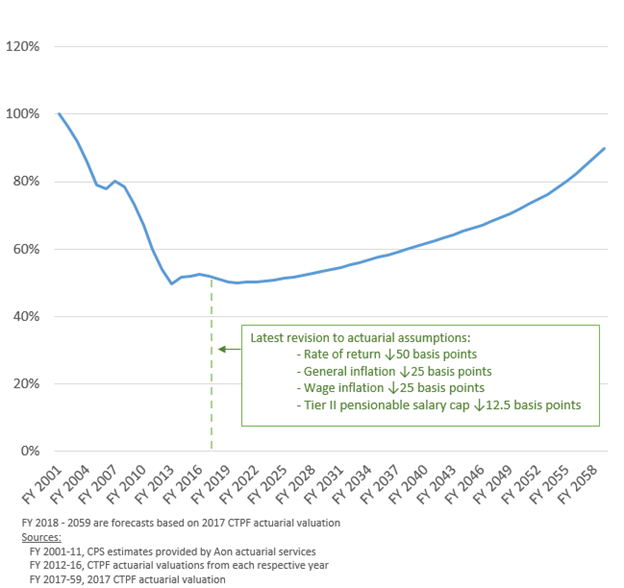

Decline in Funded Ratio Led to Increased CPS Contributions

On June 30, 2001, CTPF had a funded ratio of 100 percent, and according to state law, CPS did not have to make an employer contribution. By June 30, 2004, the funded ratio had dropped to 86 percent, below a 90 percent threshold, and therefore CPS was statutorily required, beginning in FY2006, to make employer contributions.

Chart 3: CTPF Funded Ratio Has Generally Decreased Since Late ‘90’s, Bottoming Out in FY 2013

For the FY2017 CTPF valuation, the fund — in conjunction with a new fund actuary and the fund’s regular assumptions review schedule — made a series of changes which negatively impacted the funded ratio and UAAL. Those changes were:

- Reduction in assumed rate of return from 7.75% to 7.25%

- Reduction in general inflation assumption from 2.75% to 2.50%

- Reduction in wage inflation assumption from 3.50% to 3.25%

- Reduction in future increases in pension and pensionable salary cap from 1.375% to 1.25% for current and future Tier 2 members

While these assumption changes would appear to negatively impact the health of the fund overall, the fund experienced favorable demographic changes and actual investment returns higher than the assumed rate. The combination of these factors meant CPS' required annual employer contribution remained relatively unchanged, having ultimately little impact on CPS' financial picture.

CPS’s Pension Contributions Continue to Grow

While CPS’ pension contributions continue to grow until 2059, some of the burden has been eliminated by the state beginning to pick up CPS’ teacher pension normal cost and a dedicated pension levy that was enacted at 0.383% in FY2017 and increased to 0.567% in FY2018 and beyond. Yet, until the remainder of that burden is eliminated through the state fully funding the state’s new Evidence Based Funding model, which will provide additional resources to CPS and other school districts that primarily educate low-income students, that burden will continue to be borne by Chicago taxpayers.

While much of that burden will continue to fall on Chicago taxpayers, the growth in dedicated pension levy and in state funding of CTPF normal cost is expected to outpace the growth in the required employer contribution such that by FY2037, CPS expects that those revenue sources will cover the entire annual teacher pension cost.

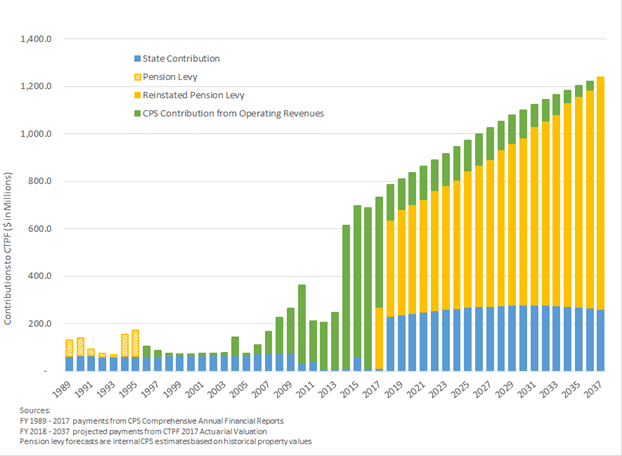

Chart 4: CPS Employer Pension Contributions Will Continue to Grow Every Year, But CPS Operations Funding Will Be Decreasingly Burdened by Pensions