After years of chronic underfunding by the state, CPS finds itself on significantly firmer revenue footing in FY2019. With the Illinois General Assembly having passed a state budget that includes $350 million of expanded financial support for public education as part of Public Act 100-586, CPS is budgeted to receive $65 million in added Evidence-Based Funding (EBF) model revenue, and $18.5 million in early childhood funding. Additionally, CPS is expecting $239 million in pension support from the state — which is an increase from prior years and a dramatic improvement in teacher pension equity in Illinois.

The FY2019 revenue budget also includes a $75 million increase in property tax revenues and a $12 million increase in Personal Property Replacement Taxes (PPRT) revenues. With lower diversions into the debt service fund, this leads to an increase of $91 million and $36 million respectively for operating use, as indicated in Table 3. This is spurred by a steady increase of new property in Chicago, as well as a general improvement in the state’s business climate.

However, revenue generation will continue to be a significant challenge for CPS in the years to come.

- Federal funding is pressured because of declining funding levels from the Trump administration.

- By statute, the State has declared that it intends to ramp up its education funding to fully fund the EBF model. This represents a great stride toward rectifying the historical underfunding of all local education agencies in Illinois. CPS was pleased to see the State live up to its commitment in this fiscal year and expects it will do the same in coming years.

- CPS does not have an unlimited ability to increase its property tax revenues, which are its main source of local revenue. Because of the Property Tax Extension Limitation Law, if federal and state revenues were to slip, increases to CPS’ collection of property tax would likely still be capped at the rate of inflation, which has averaged around 2 percent in the past few years.

| FY2018 Budget | FY2018 Projected End of Year | FY2019 Budget | FY2019 vs. FY2018 Budget | |

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $2,909.4 | $2,909.4 | $2,984.3 | $74.9 |

| Replacement Tax | $148.7 | $168.1 | $161.1 | $12.4 |

| Other Local | $414.6 | $388.3 | $381.6 | -$33.0 |

| Total Local | $3,472.7 | $3,465.8 | $3,527.0 | $54.3 |

| State Revenues | ||||

| EBF | $1,546.2 | $1,540.3 | $1,646.3 | $100.1 |

| Capital | $13.3 | $13.3 | $13.3 | $0.0 |

| Other State | $521.0 | $631.9 | $532.8 | $11.8 |

| Total State | $2,080.5 | $2,185.5 | $2,192.4 | $111.9 |

| Federal | $813.4 | $720.7 | $836.7 | $23.3 |

| Investment Income | $1.1 | $5.6 | $5.0 | $3.9 |

| Total Revenue | $6,367.7 | $6,377.6 | $6,561.1 | $193.4 |

Table 2 illustrates how CPS revenues are distributed into operating, debt service, and capital funds. While FY2019 total revenues are $6.6 billion, only $5.9 billion are available for operations.

| Total | Amount for Debt Service | Amount for Capital | Balance for Operating Budget | |

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $2,984.3 | $81.2 | $3.7 | $2,899.4 |

| Replacement Tax | $161.1 | $34.9 | $0.0 | $126.2 |

| Other Local | $381.6 | $112.5 | $32.7 | $236.5 |

| Total Local | $3,527.0 | $228.6 | $36.4 | 3,262.1 |

| State Revenues | ||||

| EBF | $1,646.3 | $328.0 | $0.0 | $1,318.3 |

| Capital | $13.3 | $0.0 | $13.3 | $0.0 |

| Other State | $532.8 | $0.0 | $2.0 | $530.8 |

| Total State | $2,192.4 | $328.0 | $15.3 | $1,849.1 |

| Federal | $836.7 | $24.7 | $6.6 | $805.4 |

| Investment Income | $5.0 | $0.0 | $0.0 | $5.0 |

| Total Revenue | $6,561.1 | $581.3 | $58.3 | $5,921.6 |

Revenue Projections

This section summarizes the district’s major revenue sources and our projected FY2019 revenue from each source. Additional details about each revenue sources is provided in the Interactive Budget on the CPS budget website: www.cps.edu/budget.

FY2019 operating revenues are budgeted at $5.9 billion, an increase of $280 million from our FY2018 budget and $205 million more than our FY2018 estimated end-of-year operating revenues.

| FY2018 Budget | FY2018 Estimated End of Year | Variance Estimated vs Budget | FY2019 Budget | FY2019 vs. FY2018 Budget | |

|---|---|---|---|---|---|

| Property Tax | 2,808.7 | 2,808.7 | 0.0 | 2,899.4 | 90.7 |

| Replacement Tax | 90.4 | 109.8 | 19.4 | 126.2 | 35.8 |

| TIF Surplus | 88.3 | 87.9 | -0.4 | 22.3 | -66.0 |

| All Other Local | 181.1 | 180.1 | -1.0 | 214.2 | 33.1 |

| Total Local | 3,168.5 | 3,186.6 | 18.1 | 3,262.1 | 93.6 |

| State | 1,466.4 | 1,615.1 | 148.7 | 1,610.2 | 143.8 |

| State Pension Support | 233.0 | 233.0 | 0.0 | 238.9 | 5.9 |

| Federal | 773.0 | 676.8 | -96.2 | 805.4 | 32.4 |

| Investment Income | 1.1 | 5.6 | 4.5 | 5.0 | 3.9 |

| Total Revenue | 5,642.0 | 5,717.1 | 75.1 | 5,921.6 | 279.6 |

Local Revenues

Property Taxes

Property tax revenue — CPS’ largest revenue source — is projected to be $2,984 million in FY2019. Of this total, $81 million is dedicated for debt service and $4 million is restricted for capital use, resulting in a total of $2,899 million available for operating purposes, which includes the district’s pension costs. This is an increase in operating revenue of $91 million over the FY2018 budget. This increase includes $50 million from FY2018’s 2.1 percent rate of inflation, on existing and new property. Property value growth contributes $24 million in increased education levy revenues over FY2018 and another $15 million in the Chicago Teachers Pension Fund levy. There is also an assumed $2 million worth of revenue growth from the Transit Tax Increment Financing (TIF) that was created in FY2018. The amount of debt service backed by property taxes has gone down by $14 million compared to FY2018 because of the end of the levy backed by the issuance of Public Building Commission (PBC) bonds.

CPS is one of several school districts in Illinois whose ability to levy local property taxes is limited by the Property Tax Extension Limitation Law (PTELL). This law stipulates that the increases in property tax extensions within a district are limited to the lesser of five percent, or the increase in the national Consumer Price Index (CPI) for the year preceding the levy year. New construction falls outside this extension limit and is taxed at the rate permitted by the allowable extension increase under PTELL on existing property.

The CPI increase for 2018 property tax extensions (levied in 2017) held steady at 2.1 percent, the highest CPI increase since 2011 and in line with the average annual CPI growth over the last two decades.1 As a result, the increase in extensions on existing property for FY2019 will be modest, in line with the increase in FY2018. This sustained recent low growth in property tax revenues has placed even greater pressure on our other major revenue sources in recent years. Property tax revenues now make up less than half of the district’s total revenue. Without the reinstatement of the pension levy in FY2017, which Mayor Emanuel sought in Springfield, the pressure on other funding sources would be even greater.

Like other government bodies, CPS has a 60-day revenue recognition period. This allows the district to recognize FY2018-budgeted revenues received prior to August 29, 2018 as FY2018 revenues, and shifts our fiscal year revenues to be in line with the year in which property taxes are collected.

Personal Property Replacement Taxes (PPRT)

PPRT revenue is budgeted to increase from $149 million in FY2018 to $161 million in FY2019, largely due to an improving business climate in Illinois. This figure includes $35 million set aside for debt service and leaves $126 million for operating purposes, which is $36 million higher than FY2018. Debt costs are lower in FY2019 compared to FY2018 by $23 million, decreasing the diversion of PPRT revenues away from district operating funds.

Replacement taxes “replace” money that was lost by local governments when their powers to impose personal property taxes on corporations, partnerships, and other business entities were taken away by state legislation in the 1970s. The tax is currently imposed at a rate of 2.5 percent of federal taxable income for corporations, and 1.5 percent of federal taxable income for partnerships, trusts, and subchapter S corporations.

The state collects and then distributes PPRT to local taxing districts. Taxing districts in Cook County receive 51.7 percent of collections, which is divided among the county’s taxing bodies based on each district’s share of personal property collections in 1976. CPS receives 27.1 percent of the total Cook County share, which is equivalent to 14.0 percent of the statewide total.

The PPRT includes an additional state income tax on corporations and partnerships, a tax on businesses that sell gas or water, a 0.5 percent fee on all gross charges for telecommunications services excluding wireless services, and a per-kilowatt tax on electricity distributors. The primary driver of PPRT is corporate income tax receipts, which are closely tied to corporate profits.

Corporate profits have steadily improved since the end of calendar year 2015 in a climate of generally improving economic performance throughout the state and the country, thereby increasing gross corporate income tax receipts collected by the state of Illinois.

A portion of the state’s total corporate income taxes are first deposited into a Refund Fund to pay business income tax refunds. The size of that portion is determined by the Illinois Department of Revenue (IDOR), based on the size of revenues and business demand for refunds. In FY2018, that refund rate was 17.5 percent of all corporate income tax collections, leaving the remaining 82.5 percent that is largely disbursed to local governments. This budget assumes that the refund rate will decline to 15.5 percent for FY2019, as the state cites a lower than expected demand for refunds by businesses. This ensures that local governments including CPS receive a greater proportion of all statewide corporate income tax revenues.

TIF Surplus and Other Local Resources

CPS has received more than $1.3 billion in TIF funds for capital investments in schools throughout the city over the past decade. From FY2017 to FY2019 alone, there will have been a total of $26.1 million in TIF-funded projects for renovations and improvements in eight CPS schools. $18 million of TIF money will be spent on 5 school projects in FY2019.

On top of capital expenditures on schools, Mayor Emanuel is also committed to declaring a surplus of TIF funds each year. In July 2015, the Mayor announced a freeze on new spending in downtown TIF districts, which created an estimated $250 million in additional TIF surplus over five years. In FY2019, CPS is anticipating that TIF surplus revenues will decrease to a more normal level of $22 million.

“All other local” revenue includes the pension payment made by the City of Chicago on behalf of CPS employees to the Municipal Employees’ Annuity and Benefit Fund of Chicago (MEABF), and is estimated to be $52 million in FY2019. It is recorded as revenue as required by the Governmental Accounting Standards Board (GASB).

Local Contributions to Capital

FY2019 local contributions to capital projects are expected to be $32.5 million. This includes $18 million in TIF-related project reimbursements and $14.5 million from other local funding sources.

State Revenue

CPS is now in the second year of the statewide Evidence Based Funding (EBF) formula, the successor to General State Aid (GSA) that was enacted in FY2018 as Public Act 100-465 after the Illinois General Assembly passed Senate Bill 1947 in August 2017. In the first year since its passage, by restoring some of the funding that high-need districts like CPS have lost over the past several years, EBF has righted some of the inequities that has been a consistent feature of education funding in Illinois.

For decades, GSA was based on the concept that the state would make up the difference between a local school district’s ability to raise local revenue (primarily from property taxes and PPRT) and a predetermined per-student “foundation level”. That system was designed to ensure that each school district received at least a minimum level of funding per student.

However, from 2010 onwards, the state held the “foundation level” constant at $6,119, and statewide appropriations for education funding failed even to meet that low level, resulting in the state deciding to “prorate” GSA distributions at a fraction of what they should have been. This deeply entrenched inequities in education funding throughout Illinois. As a result of underfunding and the proration of GSA, CPS was shorted by more than $500 million that it should have been statutorily guaranteed since 2010.

In addition to the lost revenue CPS has experienced via GSA proration, charter schools that are approved by the Illinois State Charter Commission receive funding directly from the state. This state funding is deducted from what CPS would otherwise receive for state aid. This diversion under GSA continues under EBF. In FY2018, there were five state-approved charter schools, which diverted a total of $29 million in EBF away from the district. The magnitude of that diversion is likely to decrease in FY2019 with lowered enrollment in state-approved charter schools, largely because of Amandla Charter School’s voluntary closure at the end of School Year 2017-2018.

Under the new system of EBF, districts are no longer simply allocated money up to a per-student foundation level. Instead, they are separated into four tiers, based on the percentage of an Adequacy Target that a school district is able to fulfill with local resources that fiscal year. Adequacy Targets are determined by how much it would cost to provide each student in Illinois with core investments, with added weight based on whether the student is low-income, an English Learner, and/or requires special education interventions. A Regionalization Factor is included to adjust for regional variations in employee salaries throughout the state. In addition, the EBF formula addresses long-standing pension inequities by ensuring that the state picks up the CPS teacher normal pension cost, estimated at $227 million in FY2019.

Tier 1 school districts receive the most newly appropriated “tier-funded” dollars as part of this FY2018 switch to the new EBF school funding formula. In FY2018, Tier 1 districts are those whose local resources make up less than 64 percent of their Adequacy Targets. Per ISBE, CPS’ local effort was enough to raise 62.91 percent of its Adequacy Target, and CPS is therefore considered a Tier 1 school district, among the least adequately locally funded in the state.

EBF was also designed to replace four other existing grants: (1) Funding for Children Requiring Special Education, (2) Special Education Personnel, (3) Special Education Summer School, and (4) Bilingual Education. By rolling more state funding into a means-tested formula, and by forcing more dollars through that formula to districts with high numbers of English Learners and low-income students, EBF begins to correct the errors of the previous GSA formula.

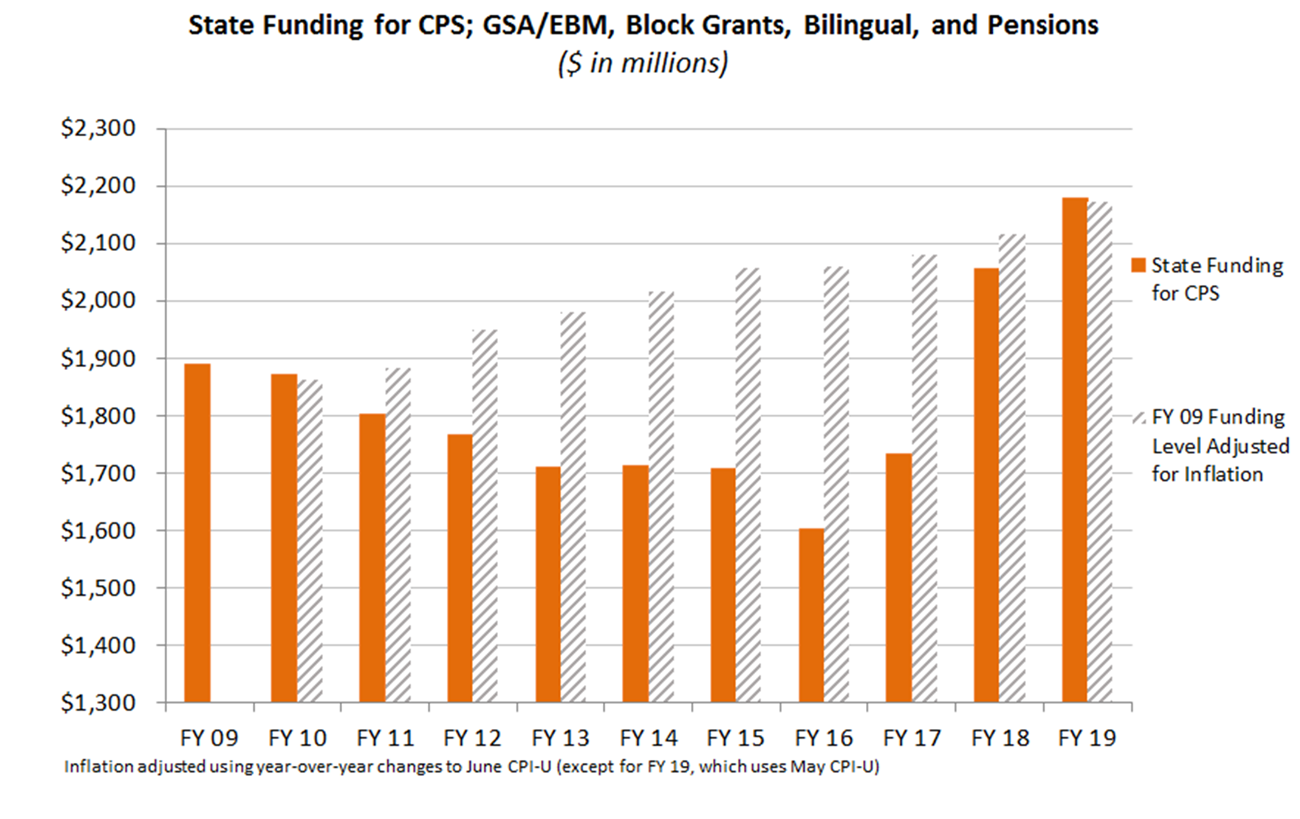

Chart 1: FY2019 - State Funding Continues to Grow, Catching Up to FY 2009 levels after inflation

State Funding Source Details

In FY2018, EBF provided CPS with an extra $470 million in budgeted state aid revenue, CPS’ main source of state operating revenue. Under EBF, CPS was budgeted to receive $1,530 million in FY2018, of which $323 million was earmarked for debt service. This partially makes up for the years of underfunding under GSA, where the district had up to 20% of statewide enrollment but only 15% of state funding, even though its students required greater funding than the statewide average.

Under Public Act 100-586, the FY2019 Illinois state budget — that was passed by the Illinois General Assembly on May 31, 2018 and signed by the Governor on June 4, 2018 — continued to make up for lost years of funding by appropriating an additional $350 million in new statewide EBF dollars and $50 million in new statewide early childhood funding.

In FY2019, this new money in the statewide budget will translate to $65 million more in EBF tier funding for CPS and another $18.5 million more in early childhood funding. In FY2018, new money distributed on a tier basis only started flowing to school districts in April, with the Illinois School Board of Education requiring several months to process final calculations.2 In comparison, the $65 million in new tier money is scheduled to begin flowing to CPS in the first payment of FY2019.

The state has many different mechanisms for funding education in Illinois. Besides EBF, state funding also comes in the form of pension contributions, categorical grants, block grants, and other sources. In FY2019, state education funding is estimated to total $13.1 billion statewide. CPS estimates receiving a total of $2.2 billion in state funds in FY2019.

Categorical Grants

Prior to Public Act 100-465’s passage, CPS received two block grants: the General Education Block Grant and Educational Services Block Grant. The grant amounts were computed by multiplying the state appropriation for the programs included in the grant by the Board’s percentage share of those programs in FY1995. The General Education Block Grant consisted of grants for early childhood education, truants alternative optional education program (TAOEP), and agricultural education. The Educational Services Block Grant consisted of grants for special education, state free and reduced meals, and pupil transportation.

Public Act 100-465 rolled four grants into the EBF funding formula, and left nine of the grants outside of the EBF formula. Instead of receiving a statutorily-defined percentage of total appropriation on eight of these grants, CPS will have to submit claims like all other districts.

The early childhood block grant remains unchanged from GSA. CPS will receive a pre-defined 37 percent of total state appropriation of the grant. In FY2019, the state appropriated an added $50 million to the statewide early childhood block grant, meaning CPS will have an extra $18.5 million in budgeted revenue to fund its early childhood Pre-K programs.

The district expects that all other grant revenues will stay constant at FY2018 budgeted levels, as CPS’ claims are largely expected to stay the same. (The bilingual grant is an exception because it is fully folded into the EBF formula as of FY2019.) The added amount in EBF disbursements is the same as what it would otherwise have been as a separate grant, hence effectively holding bilingual funding harmless from FY2018.

State Contribution for Capital

The FY2019 budget includes $15.3 million in State contributions for capital projects. This contribution is comprised of $13.3 million in gaming revenue to support construction of new schools, $1 million in other State grants, $0.8 million from Illinois Green Infrastructure Grants, and $0.3 million funded through state environmental fines.

Federal Revenues

Overview

Most federal grants require the Board to provide supplemental educational services for children from low-income or non-English speaking families, or for neglected and delinquent children from preschool through 12th grade. These grants are dedicated to specific purposes and cannot supplant local programs. Medicaid reimbursement and Impact Aid are the only federal funding that is without any restriction.

Every Student Succeeds Act (ESSA) (previously known to as No Child Left Behind)

- Title I-A – Low Income: Allocated based on a district’s poverty count, this is the largest grant received under the ESSA. The grant allows the district to provide supplemental programs to improve the academic achievement of low-income students. For FY2019, CPS estimates that Title I will be received at $231 million. This includes an anticipated reduction of $2 million in the formula-based Title I grant from FY2018 to FY2019. The anticipated total grant award for FY2019 is $251 million, which includes allowable carryover of $20 million from the previous year.

- Title I-A - Il Empower: This grant is a statewide system of differentiated supports and accountability to improve student learning, purposely designed to develop capacity to meet student needs. As of FY2019, Title I-A - Il Empower is to replace the Title I-A - School Improvement Grant 1003(a). CPS anticipates a multi-million dollar program that has not been approved to date. CPS has set-aside a sufficient amount within its revenue assumptions to compensate for the reimbursable program.

- Title I-A – School Improvement Grants 1003(g): School Improvement Grants help ensure that all students have reading and math skills at grade level. The total amount available for FY2019 is estimated at $4.4 million under these grants. A reduction of $600 thousand in funding from FY2018 is due to no new grants being awarded and grant expiration in FY2019.

- Title I-D – Neglected/Delinquent: This grant targets the educational services for neglected or delinquent children and youth in local and state institutions to assist them in attaining state academic achievement standards. Programs include academic tutoring, counseling, and other curricular activities. The anticipated allocation and carryover for FY2019 will stay level at $2.2 million.

- Title II-A – Improving Teacher Quality:> Class size reduction, recruitment and training, mentoring, and other support services to improve teacher quality are funded through this grant. Due to the Federal funding model, CPS is anticipating a reduction of $10 million from FY2018 to FY2019. CPS anticipates a total of $21 million to be awarded for the FY2019 Title II-A grant, which includes a current award of $19.4 million and an estimated $1.6 million in carryover from the previous year.

- Title III-A – Language Acquisition: Funding is provided to support students with limited English proficiency who meet eligibility requirements. The total funding available for the Language Acquisition grant will stay level at $12 million for FY2019, which comprises the estimated current-year allocation of $7 million and carryover of $5 million.

- Title IV-A – Student Support and Academic Enrichment Grants: Funding is provided to increase the capacity of states, local educational agencies, schools, and local communities to provide all students with access to a well-rounded education, improve school conditions for student learning, and provide technology in order to improve the academic achievement and digital literacy of all students. CPS anticipates a total of $13 million to be awarded for the FY2019 Title IV-A grant.

- Title IV-B – 21st Century Community Learning Centers: These grants provide opportunities for communities to establish schools as community learning centers and provide activities during after-school and evening hours. For FY2019, CPS estimates grant awards of $6.9 million, which includes an increase of $3.9 million from FY2018.

- Title VII-A – Indian Education: Funds from this grant are used to meet educational and culturally-related academic needs of American Indian and Alaska Native students. Funds are expected to increase from $204,142 to $210,023 for FY2019.

Individuals with Disabilities Education Act (IDEA)

IDEA grants provide supplemental funds for special education and related services to all children with disabilities from ages 3 through 21.

The IDEA grants include a number of programs.

- IDEA Part B Flow-Through: This is the largest IDEA grant, which is allocated based on a formula established by the state. The estimated award for the FY2019 totals $98.6 million, which includes $5 million in carryover funding from FY2018.

- IDEA Room & Board: This grant provides room and board reimbursement for students attending facilities outside of Chicago and is estimated at $2.5 million.

- Part B Preschool: This grant offers both formula and competitive grants for special education programs for children ages 3-5 with disabilities. CPS is expected to stay level at $1.4 million from the formula grant and $489,250 from a competitive grant for FY2019.

Including small competitive grants and carryover from the previous year in the preschool grant, total IDEA funding equals $103 million in FY2019.

National School Lunch Program & Child and Adult Care Food Program

CPS offers breakfast, lunch, after school supper, after school snacks, Saturday breakfast and lunch, and Head Start snacks for afternoon classes during the school year. The district also serves breakfast and lunch during summer school.

Starting in 2012, CPS opted to participate in the Community Eligibility Provision program. All schools now are part of this program, which provides all students a free lunch regardless of income eligibility. CPS is reimbursed for all lunch meals at the maximum free reimbursement rate under the National School Lunch Program.

CPS’ school breakfast programs provide breakfast in the classroom free of charge to all students regardless of income.

In addition, the USDA reimburses for free after school supper and free Head Start snacks under the Child and Adult Care Food Program. The nutrition department also takes advantage of the donated commodities program.

Federal reimbursements are projected to decrease from $203 million in FY2018 to $200 million in FY2019 due to a decrease in enrollment. These revenues include:

- $131 million from school lunches

- $48 million from breakfast programs

- $13 million of donated food from the U.S. Department of Agriculture

- $8 million of after school meals and Head Start snacks

Medicaid Reimbursement

Local education agencies are required to provide, at no cost to parents, special education and related services as delineated in the Individualized Education Program (IEP) or Individualized Family Service Plan (IFSP). Medicaid provides reimbursement for both the:

- Delivery of covered direct medical services provided to eligible children who have disabilities in accordance with IDEA, and the

- cost of specific administrative activities, including outreach activities designed to ensure that students have access to Medicaid covered programs and services.

Covered related services that can be billed to Medicaid include audiology, developmental assessments, medical equipment, medical services, medical supplies, nursing services, occupational therapy, physical therapy, psychological services, school health aide, social work, speech/language pathology, and transportation. When these services are provided under a child's IEP and that child is enrolled in Medicaid, the services are eligible for federal Medicaid reimbursement at the state’s reimbursement rate, approximately half of the established cost to provide the service.

Medicaid revenues in FY2019 are expected to be $35 million. Historically, Medicaid revenues have been negatively impacted by prior year rate adjustments, lowered indirect cost rates, and lower bill rates. However, the FY2019 Medicaid revenues will be strengthened by new revenue retention initiatives focused on improving time capture, maximizing the claiming/billing process, and ensuring all claimable costs are reimbursed.

Other Federal Grants

Other Federal Grants include competitive grants for other specific purposes. Below is a brief description of major grants under this category:

- Head Start: The United States Department of Health and Human Services provides funds for the Head Start program, which focuses on educating children from birth to five years old who are in low-income families. The program provides comprehensive education, health, nutrition, and parent involvement services to these children. CPS Head Start programs are funded through the City of Chicago. CPS anticipates receiving $36 million for the FY2019 Head Start program.

- Carl D. Perkins: This grant was established to develop academic and technical skills for career opportunities, specific job training, and occupational retraining. This grant targets students in secondary and postsecondary education. The FY2019 Perkins formula grant is anticipated at $6.1 million with an estimated rollover of $648,246.

- E-Rate: The Federal Communications Commission provides funding through its E-rate program to discount the cost of telecommunications, Internet access and internal connections for schools and libraries across the country. In FY2019, CPS estimates receiving $15.9 million of Federal E-rate money to reimburse IT projects.

Federal Contribution for Capital

The Federal contributions for capital projects is flat to FY2018 and includes a total of $6.6 million in Federal E-rate funding for upgrades to the district’s IT infrastructure.

Federal Interest Subsidy under Qualified School Construction Bonds (QSCBs) and Build America Bonds (BABs)

In FY2019, CPS has budgeted to receive a direct federal subsidy payment of $25 million for these two types of federally-subsidized bonds. This amount takes into consideration an allowance assumption of 7.5% for federal sequestration and has not changed from our FY2018 assumptions. See the Debt Management chapter for more information.